Baron23

Well-Known Member

This is a very important case and will get to be more important as the corporate pigs line up at the trough and try to patent everything about cannabis including strain genetics.

Patents on pot? U.S. lawsuit puts cannabis claims to the test

In October, the U.S. government issued Axim Biotechnologies Inc (AXIM.PK) a patent for a cannabis-based suppository to treat irritable bowel syndrome.

Britain’s GW Pharmaceuticals Plc (GWPRF.PK), which recently brought to market a drug derived from marijuana for epilepsy, is now seeking patent protection for another one to treat eczema.

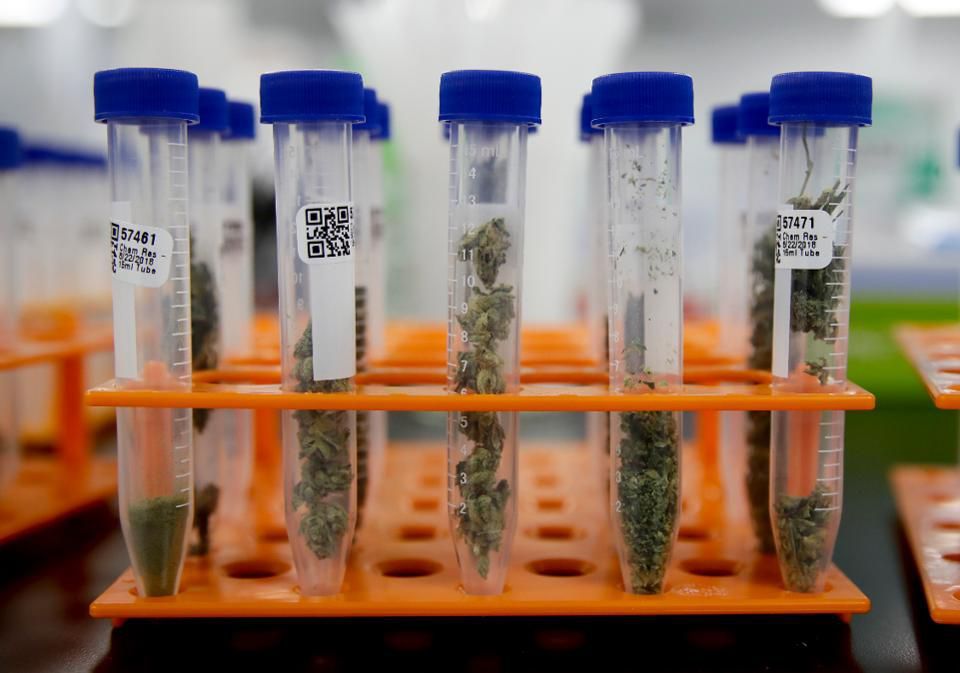

With marijuana now fully legal in Canada and at least partially legalized in the majority of U.S. states, companies are rushing to patent new formulations of the age-old botanical. This year, the U.S. Patent and Trademark Office has issued 39 patents containing the words cannabis or marijuana in their summaries, up from 29 in 2017 and 14 in 2016.

How well the patents hold up in court remains to be seen. If they do, a handful of companies could be in position to demand licensing fees from the rest of the industry.

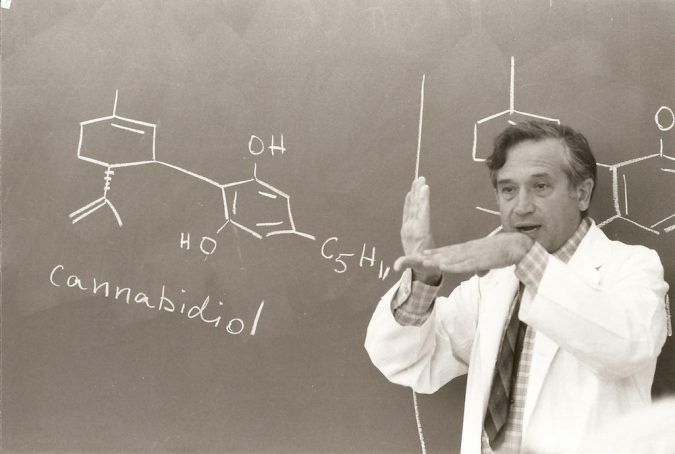

The first U.S. case is now winding its way through the courts. In a July lawsuit, Colorado-based United Cannabis Corp (CNAB.PK), accused Pure Hemp Collective Inc of infringing its patent covering a liquid formulation with a high concentration of CBD, a non-psychoactive cannabis ingredient touted for its health benefits.

One of the key issues in this case and others, experts say, is whether the patent is overly broad or obvious in light of “prior art,” the existing level of science or technology against which an invention’s novelty can be judged.

Given the long history of experimentation with marijuana, patents claiming new formulations or methods of using the drug could have trouble withstanding legal challenges, said John Stewart, a board member at Canadian cannabis company Emblem Corp.

Still, one factor that could help patent holders defend their products is the lack of documented previous research. Because marijuana has been illegal, many of its uses have not been written about in the sort of scientific articles typically presented as prior art in patent cases.

“Because of 80 years of prohibition, there is a massive lack of prior art documentation for cannabis,” said Beth Schechter, executive director of the Open Cannabis Project, a nonprofit that opposes cannabis patents. “Folk knowledge and information that is clear to the industry might not be seen or considered by the patent office.”

OBVIOUS OR INVENTIVE?

Marijuana-based patents could never really be put to the test as long as cannabis was broadly illegal. Even if companies had potential grounds to challenge a rival’s product for patent infringement, they were often reluctant to call attention to potentially criminal activities.

But in a climate of increasing tolerance the number of marijuana formulas and extracts being brought to market has exploded, opening the door to challenges from patent-holders. The worldwide cannabis industry is expected to reach $75 billion by 2030, according to Cowen & Co, making it one of the world’s fastest growing industries.

At the center of the United Cannabis case is the patent covering its formulation of CBD, which has become trendy as a health supplement and is widely available in U.S. cafes and wellness shops.

While the U.S. Drug Enforcement Agency considers CBD products to be illegal, federal prosecutors are not bringing criminal cases against sellers.

United Cannabis’ patent covering a highly-concentrated CBD formulation could potentially apply to most of the CBD products now on the market, said Neil Juneja, a patent lawyer in Seattle.

United Cannabis general counsel Jesus Vazquez declined a request for an interview but referred to a blog post from August in which he defended the company’s patented technology as “novel and inventive.”

Others say similar formulations have been used for decades.

“There are plenty of people who know the facts about cannabis extracts and biochemistry who are just up in arms over this patent,” said Dale Hunt, a patent lawyer in California.

Donnie Emmi, a lawyer for Pure Hemp, said he believed the company had a good chance of invalidating United Cannabis’ patent. In a court filing, Pure Hemp said highly concentrated liquid CBD formulations are “ubiquitous” and “were not invented in this millennium.”

INDUSTRY NEEDS TO ‘WAKE UP’

Still in its infancy, experts say the marijuana industry is largely ill-prepared for patent litigation and battles over licensing fees that may lie ahead.

“The cannabis industry needs to wake up to this business reality,” said Reggie Gaudino, a vice president at cannabis research firm Steep Hill Inc.

Part of the reason companies have been slow to recognize the threat, analysts and investors say, is that patents are foreign to the open-source, laissez-faire culture that has historically surrounded marijuana.

“This industry has traditionally been made up of people who really believed in this cause, this plant, and the health benefits,” said Kris Krane, a cannabis industry consultant.

“Most of the new players getting involved now are getting into it from a business perspective and they will look at patents as more of a business consideration.”

Patents on pot? U.S. lawsuit puts cannabis claims to the test

In October, the U.S. government issued Axim Biotechnologies Inc (AXIM.PK) a patent for a cannabis-based suppository to treat irritable bowel syndrome.

Britain’s GW Pharmaceuticals Plc (GWPRF.PK), which recently brought to market a drug derived from marijuana for epilepsy, is now seeking patent protection for another one to treat eczema.

With marijuana now fully legal in Canada and at least partially legalized in the majority of U.S. states, companies are rushing to patent new formulations of the age-old botanical. This year, the U.S. Patent and Trademark Office has issued 39 patents containing the words cannabis or marijuana in their summaries, up from 29 in 2017 and 14 in 2016.

How well the patents hold up in court remains to be seen. If they do, a handful of companies could be in position to demand licensing fees from the rest of the industry.

The first U.S. case is now winding its way through the courts. In a July lawsuit, Colorado-based United Cannabis Corp (CNAB.PK), accused Pure Hemp Collective Inc of infringing its patent covering a liquid formulation with a high concentration of CBD, a non-psychoactive cannabis ingredient touted for its health benefits.

One of the key issues in this case and others, experts say, is whether the patent is overly broad or obvious in light of “prior art,” the existing level of science or technology against which an invention’s novelty can be judged.

Given the long history of experimentation with marijuana, patents claiming new formulations or methods of using the drug could have trouble withstanding legal challenges, said John Stewart, a board member at Canadian cannabis company Emblem Corp.

Still, one factor that could help patent holders defend their products is the lack of documented previous research. Because marijuana has been illegal, many of its uses have not been written about in the sort of scientific articles typically presented as prior art in patent cases.

“Because of 80 years of prohibition, there is a massive lack of prior art documentation for cannabis,” said Beth Schechter, executive director of the Open Cannabis Project, a nonprofit that opposes cannabis patents. “Folk knowledge and information that is clear to the industry might not be seen or considered by the patent office.”

OBVIOUS OR INVENTIVE?

Marijuana-based patents could never really be put to the test as long as cannabis was broadly illegal. Even if companies had potential grounds to challenge a rival’s product for patent infringement, they were often reluctant to call attention to potentially criminal activities.

But in a climate of increasing tolerance the number of marijuana formulas and extracts being brought to market has exploded, opening the door to challenges from patent-holders. The worldwide cannabis industry is expected to reach $75 billion by 2030, according to Cowen & Co, making it one of the world’s fastest growing industries.

At the center of the United Cannabis case is the patent covering its formulation of CBD, which has become trendy as a health supplement and is widely available in U.S. cafes and wellness shops.

While the U.S. Drug Enforcement Agency considers CBD products to be illegal, federal prosecutors are not bringing criminal cases against sellers.

United Cannabis’ patent covering a highly-concentrated CBD formulation could potentially apply to most of the CBD products now on the market, said Neil Juneja, a patent lawyer in Seattle.

United Cannabis general counsel Jesus Vazquez declined a request for an interview but referred to a blog post from August in which he defended the company’s patented technology as “novel and inventive.”

Others say similar formulations have been used for decades.

“There are plenty of people who know the facts about cannabis extracts and biochemistry who are just up in arms over this patent,” said Dale Hunt, a patent lawyer in California.

Donnie Emmi, a lawyer for Pure Hemp, said he believed the company had a good chance of invalidating United Cannabis’ patent. In a court filing, Pure Hemp said highly concentrated liquid CBD formulations are “ubiquitous” and “were not invented in this millennium.”

INDUSTRY NEEDS TO ‘WAKE UP’

Still in its infancy, experts say the marijuana industry is largely ill-prepared for patent litigation and battles over licensing fees that may lie ahead.

“The cannabis industry needs to wake up to this business reality,” said Reggie Gaudino, a vice president at cannabis research firm Steep Hill Inc.

Part of the reason companies have been slow to recognize the threat, analysts and investors say, is that patents are foreign to the open-source, laissez-faire culture that has historically surrounded marijuana.

“This industry has traditionally been made up of people who really believed in this cause, this plant, and the health benefits,” said Kris Krane, a cannabis industry consultant.

“Most of the new players getting involved now are getting into it from a business perspective and they will look at patents as more of a business consideration.”