Interesting article from WaPo with some great pics.

Outlaw weed comes into the light

Humboldt County, the heart of California’s dark marijuana economy, is facing a new market force: legalization.

The quaint town plaza here is lined with locally owned stores, their names and products recalling the post-Flower Power migration from San Francisco decades ago: Moonrise Herbs, Heart Bead, Hemp Recycled Solutions.

The shops trade largely in cash with customers who are paid in cash — the marijuana growers, distributors and “trimmigrants,” seasonal workers who cut back the flowering plants for market each autumn. But business is stalling as marijuana’s dark cash economy comes into the light, pushed by the state’s

legalization of the drug earlier this year.

Humboldt County, traditionally shorthand for outlaw culture and the great dope it produces, is facing a harsh reckoning. Every trait that made this strip along California’s wild northwest coast the best place in the world to grow pot is now working against its future as a producer in the state’s $7 billion-a-year marijuana market.

A massive industry never before regulated is being tamed by laws and taxation, characteristically extensive in this state. Nowhere is this process upending a culture and economy more than here in Humboldt, where tens of thousands of people who have been breaking the law for years are being asked to hire accountants, tax lawyers and declare themselves to a government they have famously distrusted.

“We’re at that moment in the movie ‘Thelma and Louise’ when they have driven the car off the cliff,” said Scott Greacen, a longtime Humboldt resident and environmentalist who is both a supporter and critic of the marijuana trade. “We’re just waiting for the impact.”

Fewer than 1 in 10 of the county’s estimated 12,500 marijuana farmers are likely to make it in the legal trade. Growers who have anticipated legalization are preparing for a shift from badlands to boutique, a cultural transformation they hope will make this county a destination to visit for its rich history, artisanal strains of cannabis, and matchless natural beauty.

The shift, already underway with property values falling and growers departing, will be painful and unfamiliar. Marketing and consulting operations are appearing, along with logos branding various marijuana strains. Even the local terminology is changing. “Cannabis” is now the preferred public term for “marijuana,” though in casual conversation it is still just “weed.”

Basil Tolson lights up in Arcata, Calif. Tolson, who lives in Kentucky, said he appreciates the medical benefits of cannabis and hopes it will become legal in his home state.

Once prized, Humboldt’s remoteness is a drawback in the age of legal pot, and the industry is moving to meet California’s population. Places to the south that have never been known for marijuana production — such as Santa Barbara and Salinas — are licensing hundreds of greenhouse growers to take advantage of proximity to roads, rails and airports for distribution.

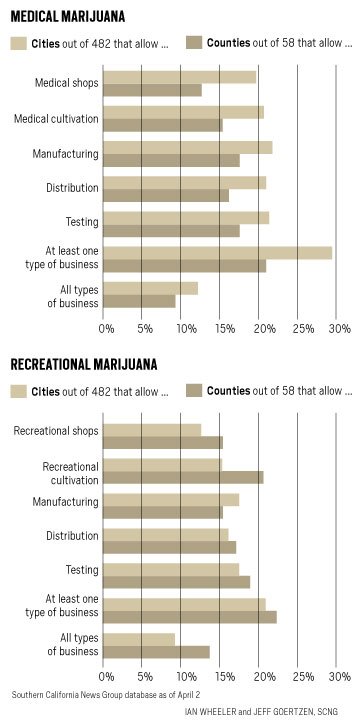

But the state licensing process is slow, threatening a fledgling legal marijuana economy by failing to eliminate a stubborn illegal one quickly enough. Of the state’s projected $4 billion legal marijuana market, industry experts say at least that much is still being supplied by illegal growers who can charge lower prices.

Less than 1 percent of the estimated 69,000 growers statewide have received a permit to farm marijuana since the beginning of the year. Thousands more are in the works, but nowhere near the total number of those now cultivating cannabis; any cannabis farmer operating without a license is cultivating illegally, and government officials could begin enforcing the law when the growing season begins in the next six weeks.

The state has issued more than 2,000 licenses to about 600 growers this year, some of whom hold dozens of them. These already-licensed growers will produce about 4.1 million pounds of marijuana annually — almost double the demand for legal weed, with tens of thousands of farmers still deciding what to do. Growers in Humboldt County, an area the size of Connecticut, produce enough marijuana each year to supply the state’s entire legal market.

The glut in legal and illegal supply has kicked the bottom out of prices at a time when small growers most need the money to begin complying with California’s stiff regulatory demands. At the same time, the state’s licensing of retail shops has been slow, leaving a lot of legal product without a legal place to be sold.

Marijuana from Humboldt that used to sell for $1,200 a pound three years ago is now selling at a 75 percent discount. State officials and many growers predict the vast overproduction will be curtailed by the new rules, likely by consolidating cultivation among large agriculture companies that can afford the regulations.

“The future of weed in Humboldt County will not be in its production,” said Mikal Jakubal, who owns a cannabis nursery in the south end of the county. “We’ll become the Napa Valley of weed. But we’re going to see a rough transition for a lot of people, and then this place will gentrify.”

A creek flows into the Eel River in Humboldt County. Humboldts economy first relied on once-plentiful salmon.

‘In it for the money’

Before pot, there were fish and timber.

Humboldt’s economy first relied on the salmon that ran in the Mattole and Eel rivers, so plentiful once that canneries lined the Eel’s mouth as it emptied into the Pacific Ocean and the shores of Humboldt Bay just to the north. Then came the logging of the pines, firs and redwoods. Lumber mills, disused for years, sit along the roads and streams that run through Humboldt’s thickly forested hills.

The population grew and changed in the 1970s, when disaffected hippies migrated north, a “back to the land” exodus from the Bay Area that brought a contempt for government ethos here. Marijuana emerged as the county’s next-generation commodity.

There is no reason people chose Humboldt to grow marijuana other than that Humboldt, as a society, allowed it to be grown. The same was true for neighboring Trinity and Mendocino counties. Collectively, the three are known as the

“Emerald Triangle,” a globally renowned pot paradise.

CLOCKWISE FROM TOP LEFT: The Eel River shines beyond a canopy of redwoods. Environmentalists are concerned about the effects of cannabis cultivation. In California’s dry summer months, which is the cannabis growing season, farms draw down the Eel and Mattole rivers to dangerously low levels. Lumber was once part of a boom economy in Humboldt. Some speculate that cannabis legalization will lead to the end of the cannabis boom here.

Swami Chaitanya has been growing marijuana on a farm in Mendocino County for 15 years, drawing water from the Blue Rock Creek, a tributary of the protected Eel River.

He called the traditional marijuana economy one of “shared risk,” where everyone on the farm-to-joint supply chain could be busted if just one were caught. He felt protected by that shared risk in a way he no longer does after declaring himself to the state.

“The location of the farm was the one thing no one could mention; it was the biggest secret in the business,” said Chaitanya, who has spent nearly $40,000 in the permitting process. “Our whole attitude toward the government has always been ‘Come and get me.’ ”

Chaitanya arrived along with thousands of other growers after state voters approved

Proposition 215 in 1996, which made marijuana legal for medical use. The law opened a gray market for pot that made it virtually impossible to crack down on illegal “grows.”

The farms moved farther into the forests, and with them came the environmental damage from illegal road-building and water consumption driven by a water-intensive, unregulated crop.

“Marijuana was just something you didn’t talk about openly,” said Mark Lovelace, referring to the political climate when he joined the Humboldt County Board of Supervisors in 2008.

CLOCKWISE FROM TOP: A worker is silhouetted by grow lights in a cannabis barn at Winterbourne Farm in Honeydew. Marijuana from Humboldt that used to sell for $1,200 a pound three years ago is now selling at a 75 percent discount. | “The free market is going to drive people out of those hills,” Mark Lovelace said. “They won’t be able to make money there anymore.“

The huge spike in cultivation drew public concerns about rising crime and environmental impact, which was increasingly obvious. Many of the cannabis migrants were far less back-to-the-land than in-it-for-the-money, and the politics around pot began to shift.

“The grows and the people doing them became very in your face,” Lovelace said. “Now, though, the free market is going to drive people out of those hills. They won’t be able to make money there anymore.”

Greenhouses made growing anywhere possible, and many of those more recently cultivated places have required makeshift roads and hilltop grading to connect them with markets. Aerial shots show once-pristine ridgelines pocked with bald patches, grows that more closely resemble mining operations than agriculture.

But local law enforcement was ill-equipped to take on what even marijuana enthusiasts could see as an industry running wild. Medical marijuana use had given many farmers a legal cover to grow — it was nearly impossible to prove they were not producing for the medical market — and local law enforcement agencies have never been big enough to police Humboldt’s armed and hidden industry.

Sheriff William Honsal, a police officer’s son known locally as Billy, grew up in Humboldt as the county cannabis industry exploded.

“You had people coming here, many in organized crime, that just wanted to suck as much out of this county as they could,” he said.

Local law enforcement carried out raids by helicopter — tactical teams fast-roping down onto pot farms — backed by long police convoys that churned up the dirt roads. Those operations were more symbolic than substantive, numbering roughly 100 a year in a county with more than 10,000 growing operations.

Now Honsal has state law and more effective tools to use — civil penalties rather than criminal. No longer is there a gray market for marijuana; growers either have a permit to cultivate or they do not. If they do not, a $10,000-a-day fine can be levied against them for each violation and, after 90 days, a lien attached to the property.

“We are very happy that the lines are drawn as black and white,” Honsal said. “There’s too much risk and not enough reward, and in years past here, it was the opposite.”

Stephanie Tidwell, executive director of the nonprofit Friends of the Eel River, paddles the Eel.

‘Lost Boys’ and lost fisheries

The south fork of the Eel River, protected by state and federal law, runs through Humboldt’s marijuana heartland. The color of dull copper, it flows swiftly after a recent storm despite an ongoing drought, snow appearing auspiciously on the top of Rainbow Ridge.

But the river’s color is a problem, even if the depth of its channel this time of year is where it should be. Silt clouds the current as it runs through valleys heavy with marijuana cultivation, which both draws water from the river and fills it with runoff that stifles the once-thriving Coho, Steelhead and Chinook salmon populations.

Greacen, the environmentalist, works for the nonprofit

Friends of the Eel River. With the group’s executive director, Stephanie Tidwell, the two guided a few kayaks down the south fork recently, through giant redwoods and invisible cannabis plantations, like those in Panther Gap that Greacen said hold “more weed than you’ve ever seen.”

“They’re like the ‘Lost Boys’ up there,” he said, citing Peter Pan’s clan to characterize the oddball collection of Brazilians, Spaniards, Portuguese and others who have grown up high in the hills for decades.

Greacen first arrived in Humboldt nearly 30 years ago to participate in the fight over commercial logging in the

Headwaters Forest, ancient and now protected. The demonstrations marked Humboldt as a hive of environmental activism.

But as marijuana cultivation grew exponentially in the “green rush” following Proposition 215, pot and environmental protection have come into conflict. The consequences of growing marijuana where it should not be grown have been devastating.

In California’s dry summer months, which is the cannabis growing season, farms draw down the Eel and Mattole, along with their tributaries, to dangerously low levels. “You could walk this whole thing in the summer,” Greacen said of the south fork.

The larger problem is the sediment that runs off the illegally graded farms and into the rivers.

Along the south fork of the Eel, it is easy to see the contrast. The kayaks loop around a bend and, where Bull Creek empties into it from a thick stand of forest, the water is as clear as vodka. As salmon run upstream, they must increasingly find these creeks, cold and clear, in place of the Eel itself to spawn successfully.

“Salmon Creek no longer has any salmon in it because there is so much dirt at the bottom,” Greacen said. Regarding Coho salmon, Greacen said, “If we lose them in the south fork, then we lose them in the Eel, and if we lose them in the Eel, then we lose them in the region.”

Water from a stream merges with the sediment-dense Eel River, clogged by runoff from illegally graded pot farms.

New state regulations seek to address water use, at least for those growers who decide to become legal. Runoff will be measured now, and growers fined sharply for violations.

Growers eventually will be required to build water tanks or ponds that will allow them to store water in the wet winter months and use it, rather than rivers, in the dry growing season.

“With water here, it’s feast or famine,” said Cris Carrigan, director of the Office of Enforcement at the

State Water Resources Control Board. “The focus here is to help cultivators take advantage of the times of feast so they do not have to exercise their diversion rights in times of famine.”

On the banks of Redwood Creek, which feeds the Eel’s south fork, Jakubal has been preparing his nursery for legalization for several years.

Bald, wiry with a buzzing energy, Jakubal listed several pending projects that he said will make him more competitive in the legal economy.

In front of his property, the creek has been slowed by fallen trees and roots, intentionally placed with the assistance of an environmental consultant to form a natural pool. The slowed stream creates a salmon habitat and a water source from which Jakubal can draw in wet months.

He rarely needs to, and never in the summer. He built a 250,000-gallon catchment pool at the foot of his property, which he uses to fill several large storage tanks near his greenhouses at the top of it. But across the creek are two other farms, neither of which has made any water storage preparation.

Mikal Jakubal examines a diversion on Redwood Creek, an important habitat for salmon, in Humboldt County.

Jakubal’s business,

Plant Humboldt, sells strains of young cannabis plants to growers, and the economics, even in this changing market, are good. There will be a retail side soon, with legalization allowing every adult to grow as many as six plants without a license.

Inside his greenhouses sit hundreds of inch-high plants in small plastic trays, which bear handwritten labels identifying strains such as “Pineapple MG” and “Dream Queen.” With little overhead, apart from the $22 an hour he pays his small crew of workers, Jakubal sells thousands of plants each year for as much as $50 each.

Meeting the new state regulations and paying taxes will cut into that by a sizable chunk. But Jakubal said that in his niche market he could increase business fivefold as Humboldt’s industry shifts from mass production to specialty items.

“We’re providing an experience here, a place people can come and pick their own plants,” he said. “There’s a history here, a culture here, and an incredible knowledge base. People will come to Humboldt County to get Humboldt strains from Humboldt growers.”

CLOCKWISE FROM TOP: Flowers bloom in Humboldt County. “People will come to Humboldt County to get Humboldt strains from Humboldt growers,” said Mikal Jakubal, who owns Plant Humboldt nursery. Inside Plant Humboldt nursery sit hundreds of inch-high plants with labels such as “Pineapple MG” and “Dream Queen.“

Innovation, and an enduring black market

“It’s important to acknowledge that this did not happen overnight,” said Scott Davies over a plate of sashimi at one of two sushi restaurants this town of 18,000 people supports on its thriving, if still largely illegal, economy.

Davies is the face of modern Humboldt cannabis: close-cropped graying hair, stylish glasses, a grandfather pot farmer whose business already complies with environmental regulations. For years, he has been preparing for his thriving family business to be legal.

Yes, the new regulations, or any regulations at all, appear overwhelming to many of his colleagues. But surprise, including surprise from state officials that more growers are not complying, is no excuse for not being ready for what is unfolding.

Related

“Cannabis will be everywhere”

“Cannabis will be everywhere”

“At every level in this process, the learning curve is at its steepest right now,” said Davies, 50, who moved to southern Humboldt County three decades ago to farm marijuana.

Davies’s main business is Winterbourne Farms, which spreads out along 40 acres next to the Mattole River. The operation produces as much as 1,500 pounds of cannabis a year and now employs his four children and son-in-law.

He has remade his business over the years. Where once he had to house and feed seasonal workers to harvest the crop, today he has turned manufacturing space in this city’s designated “Cannabis Innovation Zone” into a distribution hub.

His marketing of Humboldt marijuana, which he described traditionally as a mix of “dude bro” and “reggae” messaging, is as polished as a product from an elite craft brewery.

“Humboldt Legends” comes in logoed bags containing a small pack of five joints inside, sealed with the commercial stamp of a state-regulated product. The retail cost for the pack is $26.

What Davies fears is the resilience of the illegal marijuana trade. He said until the state licenses enough cannabis shops — and cracks down on those selling illegally — retailers will continue buying from the black market “because it’s cheaper and because they can.”

“I don’t expect the black market to go away,” Davies said. “But I do expect not to have to compete with it in the regulated retail channel. In a world where all trade is in the black market, my skills mean nothing.”

Redwoods tower over Avenue of the Giants in Humboldt Redwoods State Park.

“Cannabis will be everywhere”

“Cannabis will be everywhere”