Marijuana has been legal in Canada for a year. So why are most users still buying it from criminals?

PHOTO: Despite the nation legalising cannabis, consumers aren't sold (file photo). (Reuters: Carlos Osorio)

In many ways, Dana is a typical Canadian cannabis consumer.

She's young, professional, and — despite the country legalising the sale of marijuana last year — still buys her weed on the black market.

"It's legal here, but it's not legal elsewhere," she says.

"I travel to the US quite a bit and I need to be eligible for visas in other places. I just don't trust that the information about me buying weed will not be shared and used against me in this era of insecure data."

Rather than buying from government-approved suppliers, the yoga teacher and designer prefers to get her marijuana from friends, family members and an illegal dispensary near her home in Toronto.

She trusts the product she gets from her black market sources — and the high that it provides.

"I'm not someone who, like, wants to be hit over the head with weed. I'd prefer something a bit milder," she says.

"A lot of the brands that are being sold at the official stores are bred and grown hydroponically, so they tend to be incredibly strong and that's just not why I do it."

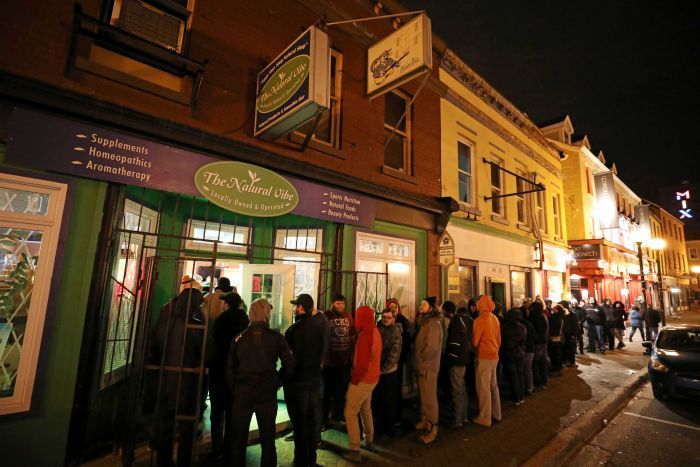

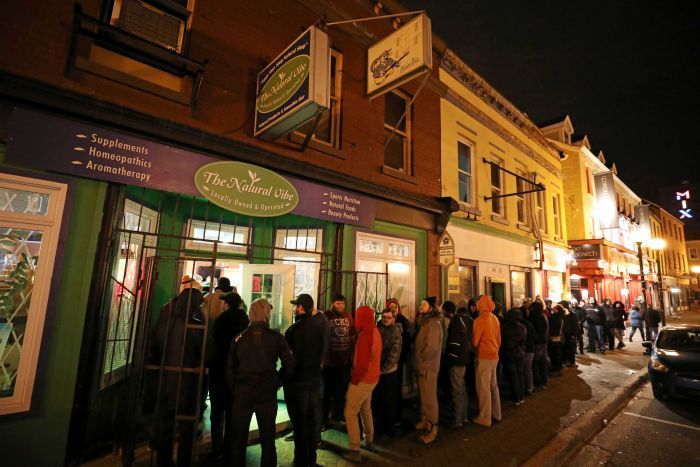

PHOTO: Online retailers have proved to be dramatically less popular than brick and mortar stores. (Reuters: Chris Wattie)

Legal producers have to 'start from scratch'

When the Cannabis Act passed through Canada's parliament last year, making it only the second nation in the world to legalise marijuana, Prime Minister Justin Trudeau proclaimed it would "keep the money out of the pockets of organised crime".

But one year since the law came into effect, the government's vow to "completely replace" the illicit trade in cannabis remains unfulfilled.

In fact, despite the rollout of legal marijuana stores and online retailers, the government's own statistics show that almost half of buyers — people like Dana — get their weed from drug dealers and illicit dispensaries.

According to Michael Armstrong, an associate professor at Brock University's Goodman School of Business, it comes down to the restrictions around legalisation.

Canada's version is different to what's been rolled out in American states like California and Colorado, where the objective was to bring illegal producers out into the open.

"Canada went with a different model, a regulated pharmaceutical model," Professor Armstrong said.

"So any existing producer who wanted to be part of the legal side would have to start from scratch," he said.

"I'm sure that what most of them decided to do instead was just keep producing for the black market, because it's still as profitable as ever."

'It's a little less clinical'

There's also the convenience of having a branch of the illegal dispensary chain CAFE close by.

The Toronto municipal government has struggled to shut down the retailer, even with a concerted program of raids.

Police have gone so far as to install giant concrete barriers to block the entrances of some locations, only to be forced to remove them after discovering people were living inside or staff had moved sales onto the street.

"I think that there's a much, like, a much better vibe at the dispensaries," said Dana.

Quebec and Ontario, which account for more than half the country's population, have opened just 47 stores between them.

Alberta, meanwhile, hosts more than 250, despite having a fifth as many residents.

PHOTO: Police have gone so far as to install giant concrete barriers to block the entrances of some CAFE chains. (Supplied: Alex McClintock)

And although online sales are available in every province, they've proved to be dramatically less popular than brick and mortar stores.

The end result is that many Canadian stoners, particularly in rural and regional areas of Quebec and Ontario, prefer to get their pot the same way they always have.

Even in Toronto, where five stores serve a population of three million, buying cannabis legally can be a hassle.

"The stores are still only in certain parts of the city," said Dana.

"And because there's so few of them, there's often really long lineups and this arduous process where they're constantly checking ID, and it can just take a really long time."

Not enough to go around

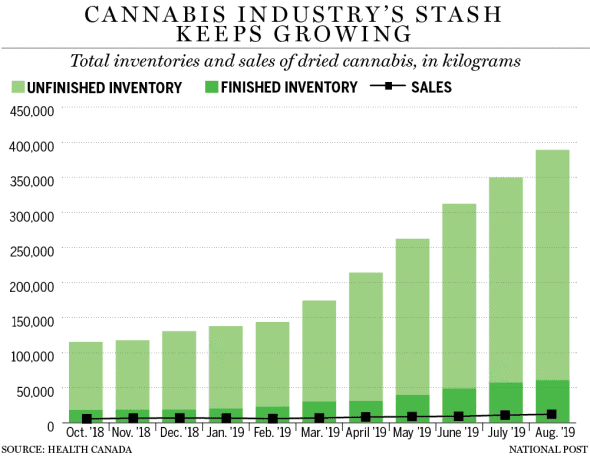

Then there are problems with supply. The first year of legalisation has been characterised by shortages, especially of dried flower — the standard type of cannabis for smoking.

Producers, many of whom are new to the industry, have had difficulty processing enough cannabis to meet demand and struggled with government labelling requirements, leading to empty shelves and consumer complaints about mouldy products.

"Last October, producers had not yet developed enough capacity to process and ship dry cannabis products," said Professor Armstrong.

"That was kind of expected, but it was less expected that it took them six months before they started to successfully increase output."

According to Jay Rosenthal, the president of the industry research firm Business of Cannabis, the legal sector is not yet able to provide the same kind of high-end product the most sophisticated consumers demand.

At the same time, black market prices have actually fallen since legalisation.

"A recent study showed that 10 per cent of cannabis users consume two-thirds of all cannabis," said Rosenthal.

And for Canadians who want to eat their marijuana rather than smoke it, the black market is still the only option.

The Cannabis Act dictated that legalisation be phased: the manufacturing of edible products was only allowed from last week, and the certification process means they won't hit shelves until December.

Year two and beyond

Both Rosenthal and Armstrong agree that the legal sector will continue to chip away at the illicit share of the cannabis market in the coming years.

Rosenthal predicts the rollout of edible products, topical creams and vape oils will be a game changer, while Armstrong points out that the old way of doing things was never going to change overnight.

"You had this established black market around for a long time," he said.

PHOTO: It's expected the legal sector will continue to chip away at the illicit share of the cannabis market in the coming years. (Reuters: Carlos Osorio)

"It was an experiment, particularly at the provincial level, so now is a perfect time for governments to go back and review what's happened in the first 12 months and start learning from that experiment."

PHOTO: Despite the nation legalising cannabis, consumers aren't sold (file photo). (Reuters: Carlos Osorio)

In many ways, Dana is a typical Canadian cannabis consumer.

She's young, professional, and — despite the country legalising the sale of marijuana last year — still buys her weed on the black market.

"It's legal here, but it's not legal elsewhere," she says.

"I travel to the US quite a bit and I need to be eligible for visas in other places. I just don't trust that the information about me buying weed will not be shared and used against me in this era of insecure data."

Rather than buying from government-approved suppliers, the yoga teacher and designer prefers to get her marijuana from friends, family members and an illegal dispensary near her home in Toronto.

She trusts the product she gets from her black market sources — and the high that it provides.

"I'm not someone who, like, wants to be hit over the head with weed. I'd prefer something a bit milder," she says.

"A lot of the brands that are being sold at the official stores are bred and grown hydroponically, so they tend to be incredibly strong and that's just not why I do it."

PHOTO: Online retailers have proved to be dramatically less popular than brick and mortar stores. (Reuters: Chris Wattie)

Legal producers have to 'start from scratch'

When the Cannabis Act passed through Canada's parliament last year, making it only the second nation in the world to legalise marijuana, Prime Minister Justin Trudeau proclaimed it would "keep the money out of the pockets of organised crime".

But one year since the law came into effect, the government's vow to "completely replace" the illicit trade in cannabis remains unfulfilled.

In fact, despite the rollout of legal marijuana stores and online retailers, the government's own statistics show that almost half of buyers — people like Dana — get their weed from drug dealers and illicit dispensaries.

According to Michael Armstrong, an associate professor at Brock University's Goodman School of Business, it comes down to the restrictions around legalisation.

Canada's version is different to what's been rolled out in American states like California and Colorado, where the objective was to bring illegal producers out into the open.

"Canada went with a different model, a regulated pharmaceutical model," Professor Armstrong said.

According to Professor Armstrong, there's "no way" a basement grow-op or even a "relatively well-built" green house would be able to pass the inspection standards."Health Canada would issue licences to producers, who had to develop growing areas with very high cleanliness standards, lots of monitoring and lots of testing."

"So any existing producer who wanted to be part of the legal side would have to start from scratch," he said.

"I'm sure that what most of them decided to do instead was just keep producing for the black market, because it's still as profitable as ever."

'It's a little less clinical'

There's also the convenience of having a branch of the illegal dispensary chain CAFE close by.

The Toronto municipal government has struggled to shut down the retailer, even with a concerted program of raids.

Police have gone so far as to install giant concrete barriers to block the entrances of some locations, only to be forced to remove them after discovering people were living inside or staff had moved sales onto the street.

"I think that there's a much, like, a much better vibe at the dispensaries," said Dana.

By contrast, differing approaches from provincial governments mean that in many parts of Canada, there aren't enough legal cannabis retailers to meet demand."It's a little less clinical, a little more personal. The people who work in those spaces are cool and they have the knowledge."

Quebec and Ontario, which account for more than half the country's population, have opened just 47 stores between them.

Alberta, meanwhile, hosts more than 250, despite having a fifth as many residents.

PHOTO: Police have gone so far as to install giant concrete barriers to block the entrances of some CAFE chains. (Supplied: Alex McClintock)

And although online sales are available in every province, they've proved to be dramatically less popular than brick and mortar stores.

The end result is that many Canadian stoners, particularly in rural and regional areas of Quebec and Ontario, prefer to get their pot the same way they always have.

Even in Toronto, where five stores serve a population of three million, buying cannabis legally can be a hassle.

"The stores are still only in certain parts of the city," said Dana.

"And because there's so few of them, there's often really long lineups and this arduous process where they're constantly checking ID, and it can just take a really long time."

Not enough to go around

Then there are problems with supply. The first year of legalisation has been characterised by shortages, especially of dried flower — the standard type of cannabis for smoking.

Producers, many of whom are new to the industry, have had difficulty processing enough cannabis to meet demand and struggled with government labelling requirements, leading to empty shelves and consumer complaints about mouldy products.

"Last October, producers had not yet developed enough capacity to process and ship dry cannabis products," said Professor Armstrong.

"That was kind of expected, but it was less expected that it took them six months before they started to successfully increase output."

According to Jay Rosenthal, the president of the industry research firm Business of Cannabis, the legal sector is not yet able to provide the same kind of high-end product the most sophisticated consumers demand.

At the same time, black market prices have actually fallen since legalisation.

"A recent study showed that 10 per cent of cannabis users consume two-thirds of all cannabis," said Rosenthal.

"They are price sensitive and they don't have a ton of retail options. We're not providing proper quality in the right quantities at the right price.""That's a really small number of people consuming a huge chunk of the cannabis. Those people are the ones that know quality.

And for Canadians who want to eat their marijuana rather than smoke it, the black market is still the only option.

The Cannabis Act dictated that legalisation be phased: the manufacturing of edible products was only allowed from last week, and the certification process means they won't hit shelves until December.

Year two and beyond

Both Rosenthal and Armstrong agree that the legal sector will continue to chip away at the illicit share of the cannabis market in the coming years.

Rosenthal predicts the rollout of edible products, topical creams and vape oils will be a game changer, while Armstrong points out that the old way of doing things was never going to change overnight.

"You had this established black market around for a long time," he said.

PHOTO: It's expected the legal sector will continue to chip away at the illicit share of the cannabis market in the coming years. (Reuters: Carlos Osorio)

"Canada went first. We couldn't say 'look, here are five other countries: what worked for them and what didn't?'"It's not going to go away quietly, just like any other industry. It's going to fight back and try and stay competitive.

"It was an experiment, particularly at the provincial level, so now is a perfect time for governments to go back and review what's happened in the first 12 months and start learning from that experiment."