Baron23

Well-Known Member

Canada's Marijuana Industry Has a New Problem

For years, cannabis stocks were the greatest thing since sliced bread on Wall Street. The expectation of ongoing state-level legalization in the U.S., coupled with Canada becoming the first industrialized country in the modern era to give marijuana the green light, was forecast to send pot stock valuations into the heavens -- and for a period of time this is precisely what happened.

However, marijuana stock investors have received a dose of reality since the end of March 2019. Supply issues have been persistent throughout Canada, whereas exorbitant tax rates on legal weed remain problematic in the United States. Though the long-term outlook for the legal pot industry is still very compelling, the near-term appears challenging.

This is especially true for the Canadian marijuana industry.

Canadian pot stocks appeared to have a clear path to outperform in Q2

Canada was expected to be a cannabis leader, but it completely blew its chance to be the industry's blueprint due to regulatory-based miscues and overzealous capacity expansion.

Then again, Canada looked to be turning the corner during the coronavirus disease 2019 (COVID-19) pandemic. According to Statistics Canada, revenue from licensed cannabis stores has been hitting record highs. Here are the latest monthly cannabis store sales figures (all figures in Canadian dollars (CA$)):

Oh how wrong I've been.

Image source: Getty Images.

The Canadian weed industry has a new problem on its hands

Through this past week, we've witnessed two of Canada's major licensed producers unveil their latest quarterly operating results. In both instances, even with Canadian licensed pot sales up notably since the year began, the licensed producers delivered underwhelming results.

Last week, it was Cronos Group (NASDAQ:CRON), which reported almost $9.9 million in quarterly sales, $2.17 million of which originated in the United States. Unfortunately, Cronos wrote down more than $3 million in inventory, which, in addition to $9.8 million in cost of goods sold, led to a gross loss of $3 million and an operating loss of $34.8 million for the quarter.

Prior to Cronos Group, it was New Brunswick-based OrganIGram Holdings (NASDAQ:OGI) delivering a dud. OrganiGram's May-ended quarter featured CA$18 million in net sales, down from CA$24.8 million in net sales in the prior-year quarter. On an operating basis, and inclusive of an unfavorable fair-value adjustment on biological assets, OrganiGram produced a loss from operations of a staggering CA$99.3 million.

Though there's plenty of finger-pointing to go around following these abysmal results, one particular similarity stands out with these companies: They both placed some degree of blame on falling net selling prices for cannabis.

In Cronos Group's press release, it was worded as "cannabis product price compression in the Canadian market." Meanwhile, OrganiGram's press release referred to it as "a lower average price driven by increased competition."

The point is, the Canadian marijuana industry has a brand-new problem: Plunging dried flower prices.

Image source: Getty Images.

Three reasons Canada's marijuana flower prices are falling

How is it that the net selling price of cannabis could be in free-fall when the Canadian weed industry is still relatively nascent?

To begin with, some of the blame can be assigned to regulators. In Ontario, provincial regulators stood by an ineffective lottery licensing system for dispensaries until Dec. 31, 2019, before abandoning it for a more traditional application and vetting process. This lottery system left Ontario completely unprepared -- a mere 24 stores were open by mid-October 2019 -- and led to significant supply bottlenecks in the region.

Secondly, licensed produces are partly to blame. Without any precedent to a legal marijuana industry in an industrialized country, pot stocks expanded their production capacity and made acquisitions without really understanding the ramifications of their decisions. In recent months, dried flower has flooded a market that simply doesn't have enough dispensaries to sell it.

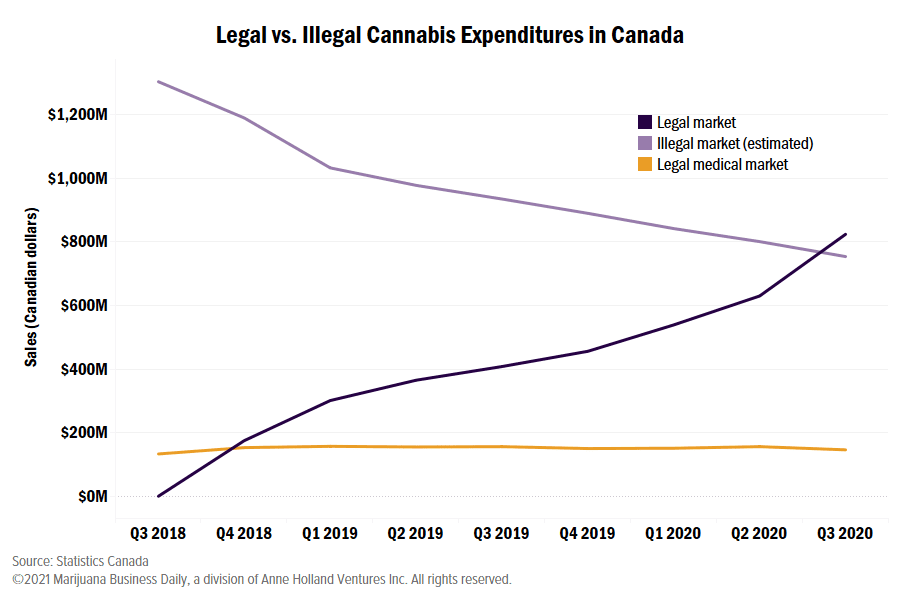

And third, the black market remains a nuisance for the Canadian cannabis industry. With taxes being levied on legal weed purchases, the only way for pot stocks to be price-competitive with the illicit industry is by producing value-branded product. While these value brands can help lure in legal-channel consumers, they've been absolutely wrecking margins and the push toward profitability (see Cronos and OrganiGram).

At this point, Canadian marijuana stocks are left with a tough choice. On one hand, they could produce a value brand in order to take on the black market and potentially secure a loyal following of consumers. Then again, doing so will wreck near-term margins. On the other hand, they can target premium product and risk not gaining significant market share, but preserve their margins in the process.

The correct path is anyone's guess at this point, which is what continues to make Canadian pot stocks a risky investment.

For years, cannabis stocks were the greatest thing since sliced bread on Wall Street. The expectation of ongoing state-level legalization in the U.S., coupled with Canada becoming the first industrialized country in the modern era to give marijuana the green light, was forecast to send pot stock valuations into the heavens -- and for a period of time this is precisely what happened.

However, marijuana stock investors have received a dose of reality since the end of March 2019. Supply issues have been persistent throughout Canada, whereas exorbitant tax rates on legal weed remain problematic in the United States. Though the long-term outlook for the legal pot industry is still very compelling, the near-term appears challenging.

This is especially true for the Canadian marijuana industry.

Canadian pot stocks appeared to have a clear path to outperform in Q2

Canada was expected to be a cannabis leader, but it completely blew its chance to be the industry's blueprint due to regulatory-based miscues and overzealous capacity expansion.

Then again, Canada looked to be turning the corner during the coronavirus disease 2019 (COVID-19) pandemic. According to Statistics Canada, revenue from licensed cannabis stores has been hitting record highs. Here are the latest monthly cannabis store sales figures (all figures in Canadian dollars (CA$)):

- March: CA$181.2 million

- April: CA$178.4 million

- May: CA$185.9 million

Oh how wrong I've been.

Image source: Getty Images.

The Canadian weed industry has a new problem on its hands

Through this past week, we've witnessed two of Canada's major licensed producers unveil their latest quarterly operating results. In both instances, even with Canadian licensed pot sales up notably since the year began, the licensed producers delivered underwhelming results.

Last week, it was Cronos Group (NASDAQ:CRON), which reported almost $9.9 million in quarterly sales, $2.17 million of which originated in the United States. Unfortunately, Cronos wrote down more than $3 million in inventory, which, in addition to $9.8 million in cost of goods sold, led to a gross loss of $3 million and an operating loss of $34.8 million for the quarter.

Prior to Cronos Group, it was New Brunswick-based OrganIGram Holdings (NASDAQ:OGI) delivering a dud. OrganiGram's May-ended quarter featured CA$18 million in net sales, down from CA$24.8 million in net sales in the prior-year quarter. On an operating basis, and inclusive of an unfavorable fair-value adjustment on biological assets, OrganiGram produced a loss from operations of a staggering CA$99.3 million.

Though there's plenty of finger-pointing to go around following these abysmal results, one particular similarity stands out with these companies: They both placed some degree of blame on falling net selling prices for cannabis.

In Cronos Group's press release, it was worded as "cannabis product price compression in the Canadian market." Meanwhile, OrganiGram's press release referred to it as "a lower average price driven by increased competition."

The point is, the Canadian marijuana industry has a brand-new problem: Plunging dried flower prices.

Image source: Getty Images.

Three reasons Canada's marijuana flower prices are falling

How is it that the net selling price of cannabis could be in free-fall when the Canadian weed industry is still relatively nascent?

To begin with, some of the blame can be assigned to regulators. In Ontario, provincial regulators stood by an ineffective lottery licensing system for dispensaries until Dec. 31, 2019, before abandoning it for a more traditional application and vetting process. This lottery system left Ontario completely unprepared -- a mere 24 stores were open by mid-October 2019 -- and led to significant supply bottlenecks in the region.

Secondly, licensed produces are partly to blame. Without any precedent to a legal marijuana industry in an industrialized country, pot stocks expanded their production capacity and made acquisitions without really understanding the ramifications of their decisions. In recent months, dried flower has flooded a market that simply doesn't have enough dispensaries to sell it.

And third, the black market remains a nuisance for the Canadian cannabis industry. With taxes being levied on legal weed purchases, the only way for pot stocks to be price-competitive with the illicit industry is by producing value-branded product. While these value brands can help lure in legal-channel consumers, they've been absolutely wrecking margins and the push toward profitability (see Cronos and OrganiGram).

At this point, Canadian marijuana stocks are left with a tough choice. On one hand, they could produce a value brand in order to take on the black market and potentially secure a loyal following of consumers. Then again, doing so will wreck near-term margins. On the other hand, they can target premium product and risk not gaining significant market share, but preserve their margins in the process.

The correct path is anyone's guess at this point, which is what continues to make Canadian pot stocks a risky investment.