Enjoy it while you can Cannabis Canada, your edge is already eroding

Green Growth Brands Ltd., a U.S.-based cannabis retailer with a large footprint in Nevada, was all geared up to enter the Ontario market until an unexpected announcement in mid-December by the province placed a drastic cap on the number of retail licences issued for pot shops.

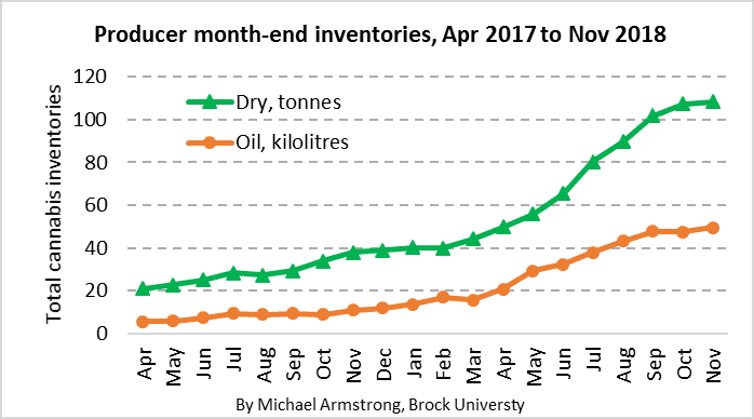

Citing supply concerns, the provincial government changed its rules from handing out more than 1,000 promised licences to a mere 25, which are being be chosen using a lottery system.

“We had hoped to have 25 stores in Toronto. But now, I don’t know if we’re even going to be in Ontario,” said Peter Horvath, chief executive of Columbus, Ohio-based Green Growth Brands. “We have the wherewithal to execute and generate tax revenues for the province. I’m not sure this was the best fiduciary move for them.”

But the changes to Ontario’s retail system are much in line with the federal government’s overall approach to legalizing cannabis, which exerts heavy control over the production and distribution of cannabis.

“This is about as regulated a marketplace as you’re going to find,” said David Phillips, former president of the Ontario Cannabis Store, the province’s sole online retailer and wholesaler.

Those restrictions are not necessarily positive say Horvath and a number of industry insiders who argue that the level of government control and intervention in the cannabis landscape, coupled with the shifting political climate south of the border in favour of federal legalization, will slowly erode Canada’s current place at the top of the cannabis leaderboard.

“It’s probably fair to say that Canadian operators are being hamstrung by policy,” said George Allen, president of Acreage Holdings, a U.S. cannabis investment company listed on the Canadian Securities Exchange. “I respect what my peers in Canada have built in terms of footprint and scale, but in terms of its relevance to the U.S. market, especially once we’re federally legalized, they might as well be growing tomatoes.”

The term “first-mover” is frequently used in reference to Canada’s cannabis industry. Indeed, the country was just the second — after Uruguay — to legalize cannabis on a national level for recreational use. Almost every cannabis company, no matter where it is headquartered, that intends to raise money on public markets lists itself on a Canadian exchange.

Bruce Linton, CEO of Canopy Growth Corp.

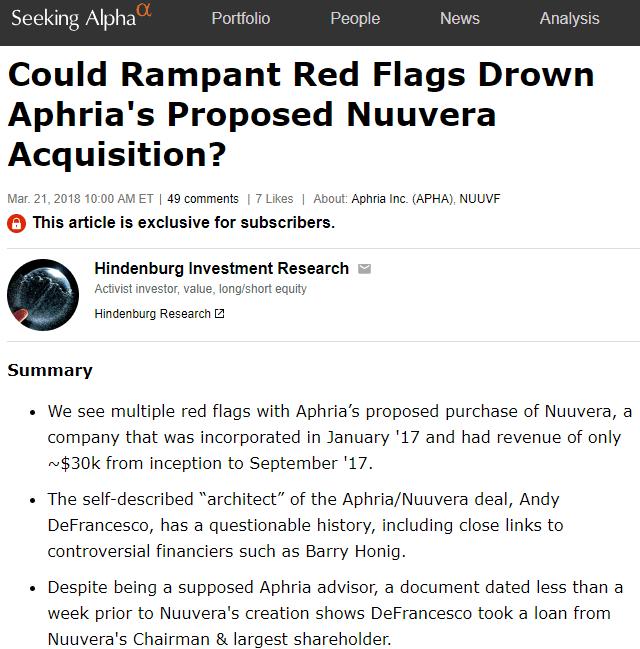

Furthermore, the largest cannabis companies — Canopy Growth Corp., Aurora Cannabis Inc., Tilray Inc., and Aphria Inc. — are Canadian and they are already carving out footprints and recognition for themselves in Europe, South America and even Africa.

But cannabis industry players that straddle investments north and south of the border are acutely aware of the differences between different individual U.S. states and Canada when it comes to the legalization of cannabis.

Afzal Hasan, president of Origin House, a cannabis products and brands company registered in Canada but operating mostly out of California, said Canada’s approach reflects a set of regulators who are “inexperienced” with cannabis.

“I don’t mean that in a negative way. But the onerous restrictions and the regulatory situation that has a monopolistic tint to it is what might set us back,” he said, citing the recent changes to Ontario’s retail system as an example.

Allen said U.S. companies started developing an edge over their Canadian counterparts after the Toronto Stock Exchange’s decision in February 2018 to not list cannabis companies with exposure to the U.S. over concerns the plant was still a banned Schedule 1 substance in the U.S.

The TSX rule meant Canadian companies could not set up shop down south, while U.S. companies could continue to operate freely in Canada.

“That must have hit Canadian cannabis companies hard,” Allen said. “But for us, that was the best decision they could have made. It allowed us to operate completely unfettered by a lot of capitalized competitors.”

The timing is ripe for companies such as Acreage to gain ground in the U.S., a market 10 times bigger than Canada.

It is widely expected that the STATES (Strengthening the Tenth Amendment Through Entrusting States) Act, a bipartisan bill crafted by senators Cory Gardner and Elizabeth Warren, will pass in 2019, paving the way for cannabis companies to obtain a full range of financial services from big federally regulated banks such as Bank of America Corp. and Goldman Sachs Group Inc., while eroding the stigma mainstream investors have in touching the cannabis sector.

“Canada is one-tenth the size of the opportunity here in the U.S. and we all know the prize is here,” said Acreage chief executive Kevin Murphy in a recent interview with CNBC’s Jim Cramer. “Big investment and big conglomerates are going to start coming back to the U.S.”

But the TSX restriction and the drive towards legalization in the U.S. are just a couple of the problems Canadian cannabis companies face in maintaining their first-mover advantage.

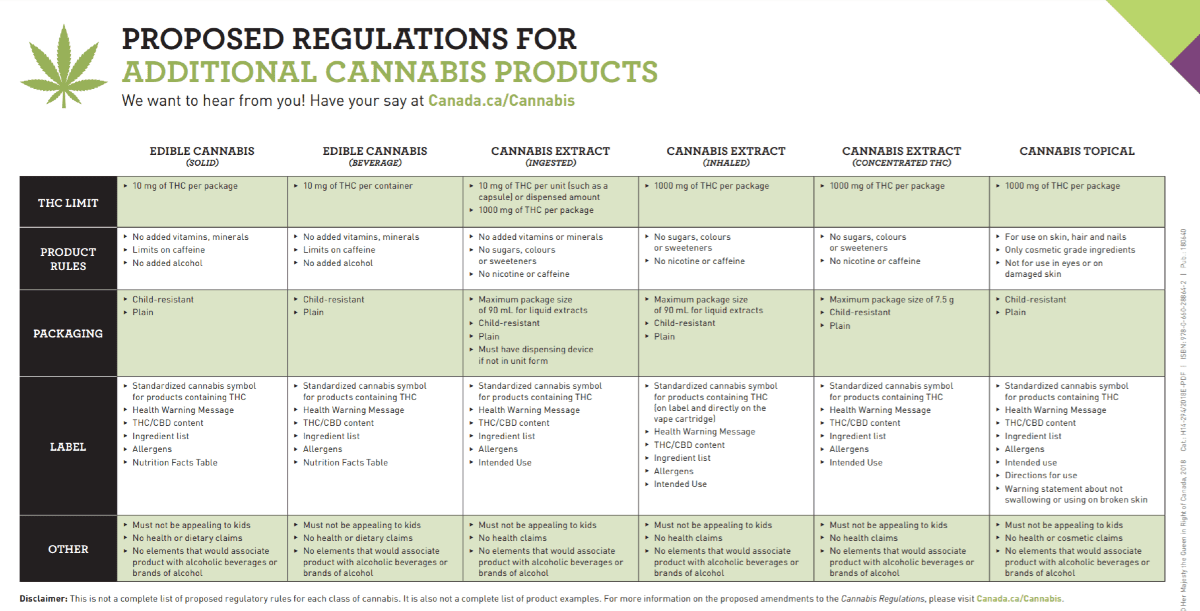

Another primary one, Hasan believes, is not acting quickly enough to allow a wide range of products across a less restrictive retail regime.

“Just to be clear, we’ve only had this pseudo-medical system that had mail-order deliveries,” he said. “We’ve never had real retail and products with substantial distribution like edibles and vape pens.”

Hasan contrasts individual provincial markets such as Ontario to California, where thousands of dispensary chains and independent dispensaries flourish, offering what he claims is the “largest variety” of cannabis products that exists globally.

“We are working in the most discerning and competitive market, so the standard of what can go on the shelves is very high,” he said. “Frankly, I can’t see any Canadian flower on the shelves in California.”

Canada, unlike many states in the U.S., has also heavily restricted marketing and advertising rules, which are much more similar to tobacco than alcohol.

In a market where there are more than 100 licensed producers, and hundreds of cannabis brands, carving out individual recognition without using branding is undoubtedly a challenge.

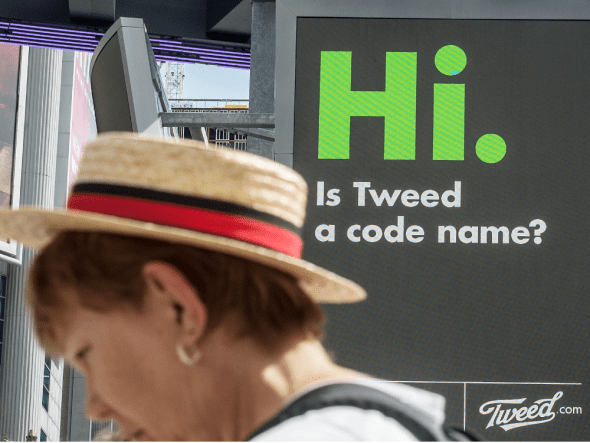

“It’s a handicap, more so for the smaller companies, than us,” said Bruce Linton, chief executive of Canopy Growth. “We knew from Day One how touchy the government was about being allowed to advertise so we did as much as we could pre-legalization to get our Tweed brand known.”

Canopy’s efforts included displaying the Tweed brand on billboards and hosting conference and company events — all legal marketing activities as long as they did not portray cannabis consumption as a lifestyle.

Canopy’s efforts included displaying the Tweed brand on billboards and hosting conference and company events — all legal marketing activities as long as they did not portray cannabis consumption as a lifestyle.

“In California, you get hip-hop artists, all kinds of artists just rocking their own brands in any way that they want,” Hasan said. “You can really push your strain of cannabis, and that’s great for consumers.”

But as the world’s largest cannabis company by market value, Canopy Growth, perhaps unsurprisingly, sees Canada’s regulations as “appropriate,” enabling the company to be very successful in markets such as Europe, where regulatory restrictions toward the medical cannabis sector are just as stringent, if not more so.

“In America, it’s just not like that. And that’s fine. They can do their thing,” Linton said. “We are well-governed and well-structured and that means that the Europeans will trust us, the South Americans, Australians, they’ll all want to do business with us.”

Of course, the way in which cannabis is regulated in the U.S. is not without its flaws, cautions Horvath.

Advertising for Canopy’s Tweed cannabis brand at Yonge and Dundas Square in Toronto prior to legalization.

For example, in setting up Washington’s legal cannabis regime, state regulators created three tiers of producers based on the square footage of each farm in order to avoid a situation where a few large producers dominate the market. But as regulators kept expanding the maximum farm size, bigger producers that could source capital ended up swallowing small-scale growers.

Now, Washington is facing a supply glut of weed, and prices have dramatically plunged since legalization.

These monopolistic “tendencies,” as Hasan calls them, also exist in multiple Canadian provinces.

For example, Manitoba’s retail cannabis system had more than 100 applicants vie for just four licences, two of which were awarded to partnerships with a connection to Canopy Growth (one directly with Winnipeg-based Delta 9 Cannabis Inc. and one between a small independent Manitoba company, B.O.B. Headquarters, and Canopy Growth-owned Tokyo Smoke).

“When I see markets like Manitoba, and the number of retail licences that were issued, and I see that they all went to the big boys, that kind of stuff doesn’t sit well with me,” Hasan said.

“I’d like the Canadian government to know that from our perspective, they’re only going to meet their goal of combating organized crime if we truly have a free market for cannabis.”

but i think the government should have just decriminalized it instead since everything was WORKING just fine as was...

but i think the government should have just decriminalized it instead since everything was WORKING just fine as was...