Australia's Green Revolution: Medical cannabis moves ever closer

Dec 26 2017

AusCann CEO Elaine Darby and her father, former MP Mal Washer. TREVOR COLLENS

by Carrie LaFrenz

Gloria Riley was a fighter. But after battling for a number of years, she succumbed to ovarian cancer in 2015.

Like millions of cancer patients, Gloria suffered pain and nausea from chemotherapy. The anorexia transformed her into a skeletal figure, as she was too sick to eat in the last few months of life. There was no medication to help her crippling nausea – except for medical cannabis, which was not legal in Australia.

It was a tragic death according to Mal Washer, a friend and her boss for more than two decades. Riley worked as his personal assistant, first in Washer's medical practice and later in federal politics, where he was a West Australian Liberal MP for the seat of Moore for 15 years.

Riley's death kick-started Washer's campaign to get medical marijuana legalised in Australia. He is co-founder and chairman of ASX-listed AusCann, which is focused on domestic sale and production of medical cannabis.

"Gloria had a terrible time … she was dying in a miserable way," he tells AFR Weekend. "The opiates and other drugs she was taking weren't working. The thing that frightens people about dying is they don't want to die in pain and don't want to die alone. I made sure those things didn't happen to Gloria.

"We had no drug that could treat the horrible nausea except cannabis and we couldn't get it except illegally. It was the wrong stuff and had some side effects she would not have had from medical cannabis. It was just a sad demise. We could help a lot of people, particularly in palliative care pain, with cannabis."

Washer adds not everyone will be suited, but many patients could be helped by a drug that is being denied by bureaucratic red tape.

Conditions that can be treated using medical cannabis include pain reduction and/or appetite stimulation for AIDS/HIV sufferers, improvement in mood scale for anxiety patients, joint destruction suppression for arthritis suffers and reduction in seizure frequency for those with epilepsy. Other possible treatments include reduction of insomnia for sleep disorders, reduction in psychotic symptoms for schizophrenia patients and improvements in tic severity for Tourette Syndrome cases.

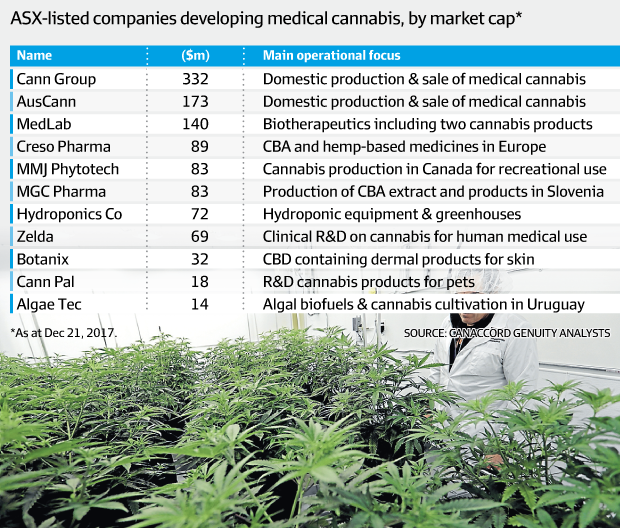

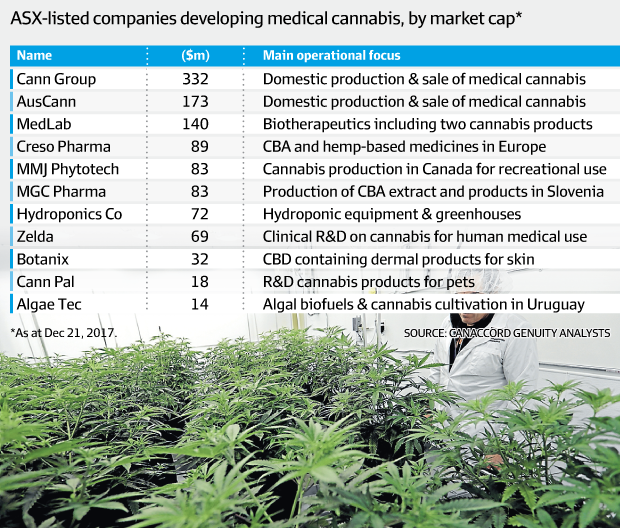

With a potential medical cannabis domestic market estimated at $1 billion a year, and a global market estimated to reach $US34 billion by 2021, AusCann is just one of several local companies eyeing the opportunities in Australia and positioning themselves for a possible change to local laws.

ASX-listed Botanix is developing topical synthetically manufactured cannabidiol (known as CBD) for treatment of skin conditions. CannPal is a pet pharmaceutical company focused on medical cannabis products, while Hydroponics Co is focused on the provision of hydroponic equipment and greenhouse design for the industry.

Given the lack of success and expense of cannabis-inspired pharmaceuticals, the focus around the world has shifted to medical cannabis, which is dried flower bud that has a known and consistent concentration of key cannabinoids and is free from pathogens.The medical cannabis is put into formulations that are administered to patients via oil, gels and capsules and creams.

AusCann chief executive Elaine Darby says the oral capsules the company will produce have a low release action which is great for chronic pain.

"The Australian market is very significant," she says. "When you consider 20 per cent of Australians suffer chronic pain ... there are about 1.8 million sufferers of nerve pain there is a big opportunity."

Darby, who is Washer's daughter and worked as a winemaker for 12 years in Margaret River before joining the venture, says AusCann will be focused on getting its products on the Australian Register of Therapeutic Goods so that doctors will not have to go through a complex approvals process to gain access to prescribe the drug.

AusCann – which is backed by the largest legal cannabis grower in the world, Canada's Canopy Growth, and also has a partnership with global poppy grower and processor Tasmanian Alkaloids – is tipped to generate revenue the next financial year when it has its own Australian products and the local market is more developed.

The Department of Health regulates medicinal cannabis products through the Therapeutic Goods Administration (TGA) and the Office Of Drug Control (ODC). Medicinal cannabis products are unregistered medicines and can only be accessed through the Special Access Scheme (SAS) or Authorised Prescriber Scheme.

But Darby and her father claim there are too many hurdles for doctors looking to become Authorised Prescribers, as they must get an endorsement letter from an ethics committee or from their specialist college. For various reasons this often is not happening.

"It is very onerous for doctors at the moment," Darby says. "In the area of pain, the college is not giving endorsement to doctors and the ethics committee is only for doctors in a hospital setting. But the turnaround is many months due to a backlog of work.

"So there are not many Authorised Prescribers. We need to reassess this. It needs to all be in the hands of the TGA. You can't put the decision with a specialist college who have various political and other reasons to be the gatekeepers."

According ot the TGA, there are only 30 doctors who had become Authorised Prescribers in 2017. It claims it is not "equipped to assess the ethical and professional practice matters" that are necessary to protect patients and are required for the scheme. The TGA is due to issue guidance on medical cannabis by the end of this year.

A spokesman for Health Minister Greg Hunt also denied claims that the current system is not delivering, pointing to a 10-fold increase in applications to nearly 380 in 2017.

"We are making it easier to access medicinal cannabis products more rapidly, while still maintaining safeguards for individual and community safety," he says. "We've legislated to allow for the first time pathways for doctors to prescribe medicinal cannabis, for domestic cultivation and manufacturing, and for importation. There are no barriers at federal level."

But a comprehensive report on the industry by Canncord Genuity analysts Matthijs Smith and Cameron Bell says that due to the restrictions in accessing legal medical cannabis many patients resort to the black market out of desperation.

The chief executive of ASX-listed CannGroup, Peter Crock, says there also needs to be harmonisation of laws across the states, which currently have their own frameworks.

"If there was a single body and it was simplified and we didn't have multiple layers of requiring clearance or approvals to prescribe, it would make a lot of sense."

Ancient history

For many people marijuana is seen as a drug used by rebellious teenagers or hippies. But it only developed this notoriety later in the 20th century after being used for medicinal purposes for thousands of years.

Today views are changing. In 2016, the Australian government legalised growing of cannabis for medical and scientific purpose. A year later the ODC issued its first licence to cultivate cannabis to CannGroup, which recently raised $60 million to support accelerated growth plans, including building a facility in Victoria which will enable the company to meet domestic and prospective export demand. Major shareholder Aurora Cannabis Inc supported the raising, increasing its holding to 22.9 per cent from 19.9 per cent.

Medicinal use of cannabis is now legal in 17 countries, and a handful of others have it under review. In the US, 26 states have legalised medicinal cannabis. Uruguay has legalised the recreational use of cannabis, with Canada set to follow in July 2018.

Perceptions about cannabis have been shifting, so much so that spirits maker Constellation Brands bought a minority stake in a Canada's Canopy Growth in October.

Tribeca Capital fund manager Craig Evans says the deal with Canopy Growth is significant for the medical cannabis industry.

"A big thing at the moment in the sector in Canada and the US is there have not been many banks in a position to finance any of these companies," he says. "There has not been any big-cap corporate support either. The Constellation Brands transaction is a starting point, it's a huge marker for the start of a bigger industry."

Evans already pointed to several products in North America like cannabis-infused ciders, taking on the traditional beverage markets which has been about wine and beer.

But in Australia it's all about the medical market. Evans compares medical marijuana to the Internet or car manufacturing boom.

"This is actually something that is a growth industry because there are products with purpose and cultural attitudes are changing," says Evans, who co-runs a $US300 million fund focused on energy, metals, mining, soft commodities and services companies.

Tribeca has bet big on medical cannabis, taking stakes in Canopy Growth, Aurora Cannabis, AusCann, CannGroup and cannabis-focused financing and advisory firm iAnthus Capital Holdings. Last year Tribeca shot up to one of the top hedge fund performers, in part due to its investments in medical cannabis.

While attitudes are changing and the government has allowed imports of medicinal cannabis to help meet demand in the local market, it will not allow imports of cannabidiols made from hemp plants.

This has triggered a campaign for reform of Australia's laws by millionaire investor and philanthropist Barry Lambert. He is the founder of the Count financial advisory group, which was bought by the Commonwealth Bank of Australia for $373 million in 2011.

Lambert and his wife Joy donated $33.7 million in funding for research at Sydney University into medicinal cannabis trials. They were motivated by their granddaughter Katelyn, who has a dangerous form of childhood epilepsy.

"We need some political change, otherwise Australia's just going to be left behind," says Lambert, who is now chairman of Ecofibre, which grows medicinal cannabis, and is also backed by fund-manager Chris Cuffe.

"We talk to politicians all the time, they say the right thing. But it's a political issue in Australia. The government prefers not to explain the difference between hemp and marijuana. We are in the hemp business, not the marijuana business. The government has not wanted to admit the difference between the two. There is zero THC in hemp seed."

Lambert and Ecofibre CEO Eric Wang in early December briefed a group of parliamentarians to push for a better regulatory framework to provide improved access of products like Ananda Hemp to Australians.

Lambert says the Australian government's legalisation of the consumption of hemp in November was good news, but argues it should have never been outlawed in the first place.

Ecofibre exited its Hunter Valley operations in March 2017, saying it was impossible to make money locally. It moved its commercial business to Kentucky the year before, investing $10 million into farmers, employees, manufacturing and marketing. It has planted 540 acres of hemp in the US.

A year ago the Lambert family made a $3 million donation to US-based Thomas Jefferson University to form Lambert Centre for the Research of Medicinal Cannabis and Hemp.

As for Washer, he has brought over people from Canada to help educate Australia's medical community. He says it is a work in progress.

"It's taken a number of years working, travelling around and lots of time and effort (to set up AusCann). I don't mind that. To me it's a passion."

Dec 26 2017

AusCann CEO Elaine Darby and her father, former MP Mal Washer. TREVOR COLLENS

by Carrie LaFrenz

Gloria Riley was a fighter. But after battling for a number of years, she succumbed to ovarian cancer in 2015.

Like millions of cancer patients, Gloria suffered pain and nausea from chemotherapy. The anorexia transformed her into a skeletal figure, as she was too sick to eat in the last few months of life. There was no medication to help her crippling nausea – except for medical cannabis, which was not legal in Australia.

It was a tragic death according to Mal Washer, a friend and her boss for more than two decades. Riley worked as his personal assistant, first in Washer's medical practice and later in federal politics, where he was a West Australian Liberal MP for the seat of Moore for 15 years.

Riley's death kick-started Washer's campaign to get medical marijuana legalised in Australia. He is co-founder and chairman of ASX-listed AusCann, which is focused on domestic sale and production of medical cannabis.

"Gloria had a terrible time … she was dying in a miserable way," he tells AFR Weekend. "The opiates and other drugs she was taking weren't working. The thing that frightens people about dying is they don't want to die in pain and don't want to die alone. I made sure those things didn't happen to Gloria.

"We had no drug that could treat the horrible nausea except cannabis and we couldn't get it except illegally. It was the wrong stuff and had some side effects she would not have had from medical cannabis. It was just a sad demise. We could help a lot of people, particularly in palliative care pain, with cannabis."

Washer adds not everyone will be suited, but many patients could be helped by a drug that is being denied by bureaucratic red tape.

Conditions that can be treated using medical cannabis include pain reduction and/or appetite stimulation for AIDS/HIV sufferers, improvement in mood scale for anxiety patients, joint destruction suppression for arthritis suffers and reduction in seizure frequency for those with epilepsy. Other possible treatments include reduction of insomnia for sleep disorders, reduction in psychotic symptoms for schizophrenia patients and improvements in tic severity for Tourette Syndrome cases.

With a potential medical cannabis domestic market estimated at $1 billion a year, and a global market estimated to reach $US34 billion by 2021, AusCann is just one of several local companies eyeing the opportunities in Australia and positioning themselves for a possible change to local laws.

ASX-listed Botanix is developing topical synthetically manufactured cannabidiol (known as CBD) for treatment of skin conditions. CannPal is a pet pharmaceutical company focused on medical cannabis products, while Hydroponics Co is focused on the provision of hydroponic equipment and greenhouse design for the industry.

Given the lack of success and expense of cannabis-inspired pharmaceuticals, the focus around the world has shifted to medical cannabis, which is dried flower bud that has a known and consistent concentration of key cannabinoids and is free from pathogens.The medical cannabis is put into formulations that are administered to patients via oil, gels and capsules and creams.

AusCann chief executive Elaine Darby says the oral capsules the company will produce have a low release action which is great for chronic pain.

"The Australian market is very significant," she says. "When you consider 20 per cent of Australians suffer chronic pain ... there are about 1.8 million sufferers of nerve pain there is a big opportunity."

Darby, who is Washer's daughter and worked as a winemaker for 12 years in Margaret River before joining the venture, says AusCann will be focused on getting its products on the Australian Register of Therapeutic Goods so that doctors will not have to go through a complex approvals process to gain access to prescribe the drug.

AusCann – which is backed by the largest legal cannabis grower in the world, Canada's Canopy Growth, and also has a partnership with global poppy grower and processor Tasmanian Alkaloids – is tipped to generate revenue the next financial year when it has its own Australian products and the local market is more developed.

The Department of Health regulates medicinal cannabis products through the Therapeutic Goods Administration (TGA) and the Office Of Drug Control (ODC). Medicinal cannabis products are unregistered medicines and can only be accessed through the Special Access Scheme (SAS) or Authorised Prescriber Scheme.

But Darby and her father claim there are too many hurdles for doctors looking to become Authorised Prescribers, as they must get an endorsement letter from an ethics committee or from their specialist college. For various reasons this often is not happening.

"It is very onerous for doctors at the moment," Darby says. "In the area of pain, the college is not giving endorsement to doctors and the ethics committee is only for doctors in a hospital setting. But the turnaround is many months due to a backlog of work.

"So there are not many Authorised Prescribers. We need to reassess this. It needs to all be in the hands of the TGA. You can't put the decision with a specialist college who have various political and other reasons to be the gatekeepers."

According ot the TGA, there are only 30 doctors who had become Authorised Prescribers in 2017. It claims it is not "equipped to assess the ethical and professional practice matters" that are necessary to protect patients and are required for the scheme. The TGA is due to issue guidance on medical cannabis by the end of this year.

A spokesman for Health Minister Greg Hunt also denied claims that the current system is not delivering, pointing to a 10-fold increase in applications to nearly 380 in 2017.

"We are making it easier to access medicinal cannabis products more rapidly, while still maintaining safeguards for individual and community safety," he says. "We've legislated to allow for the first time pathways for doctors to prescribe medicinal cannabis, for domestic cultivation and manufacturing, and for importation. There are no barriers at federal level."

But a comprehensive report on the industry by Canncord Genuity analysts Matthijs Smith and Cameron Bell says that due to the restrictions in accessing legal medical cannabis many patients resort to the black market out of desperation.

The chief executive of ASX-listed CannGroup, Peter Crock, says there also needs to be harmonisation of laws across the states, which currently have their own frameworks.

"If there was a single body and it was simplified and we didn't have multiple layers of requiring clearance or approvals to prescribe, it would make a lot of sense."

Ancient history

For many people marijuana is seen as a drug used by rebellious teenagers or hippies. But it only developed this notoriety later in the 20th century after being used for medicinal purposes for thousands of years.

Today views are changing. In 2016, the Australian government legalised growing of cannabis for medical and scientific purpose. A year later the ODC issued its first licence to cultivate cannabis to CannGroup, which recently raised $60 million to support accelerated growth plans, including building a facility in Victoria which will enable the company to meet domestic and prospective export demand. Major shareholder Aurora Cannabis Inc supported the raising, increasing its holding to 22.9 per cent from 19.9 per cent.

Medicinal use of cannabis is now legal in 17 countries, and a handful of others have it under review. In the US, 26 states have legalised medicinal cannabis. Uruguay has legalised the recreational use of cannabis, with Canada set to follow in July 2018.

Perceptions about cannabis have been shifting, so much so that spirits maker Constellation Brands bought a minority stake in a Canada's Canopy Growth in October.

Tribeca Capital fund manager Craig Evans says the deal with Canopy Growth is significant for the medical cannabis industry.

"A big thing at the moment in the sector in Canada and the US is there have not been many banks in a position to finance any of these companies," he says. "There has not been any big-cap corporate support either. The Constellation Brands transaction is a starting point, it's a huge marker for the start of a bigger industry."

Evans already pointed to several products in North America like cannabis-infused ciders, taking on the traditional beverage markets which has been about wine and beer.

But in Australia it's all about the medical market. Evans compares medical marijuana to the Internet or car manufacturing boom.

"This is actually something that is a growth industry because there are products with purpose and cultural attitudes are changing," says Evans, who co-runs a $US300 million fund focused on energy, metals, mining, soft commodities and services companies.

Tribeca has bet big on medical cannabis, taking stakes in Canopy Growth, Aurora Cannabis, AusCann, CannGroup and cannabis-focused financing and advisory firm iAnthus Capital Holdings. Last year Tribeca shot up to one of the top hedge fund performers, in part due to its investments in medical cannabis.

While attitudes are changing and the government has allowed imports of medicinal cannabis to help meet demand in the local market, it will not allow imports of cannabidiols made from hemp plants.

This has triggered a campaign for reform of Australia's laws by millionaire investor and philanthropist Barry Lambert. He is the founder of the Count financial advisory group, which was bought by the Commonwealth Bank of Australia for $373 million in 2011.

Lambert and his wife Joy donated $33.7 million in funding for research at Sydney University into medicinal cannabis trials. They were motivated by their granddaughter Katelyn, who has a dangerous form of childhood epilepsy.

"We need some political change, otherwise Australia's just going to be left behind," says Lambert, who is now chairman of Ecofibre, which grows medicinal cannabis, and is also backed by fund-manager Chris Cuffe.

"We talk to politicians all the time, they say the right thing. But it's a political issue in Australia. The government prefers not to explain the difference between hemp and marijuana. We are in the hemp business, not the marijuana business. The government has not wanted to admit the difference between the two. There is zero THC in hemp seed."

Lambert and Ecofibre CEO Eric Wang in early December briefed a group of parliamentarians to push for a better regulatory framework to provide improved access of products like Ananda Hemp to Australians.

Lambert says the Australian government's legalisation of the consumption of hemp in November was good news, but argues it should have never been outlawed in the first place.

Ecofibre exited its Hunter Valley operations in March 2017, saying it was impossible to make money locally. It moved its commercial business to Kentucky the year before, investing $10 million into farmers, employees, manufacturing and marketing. It has planted 540 acres of hemp in the US.

A year ago the Lambert family made a $3 million donation to US-based Thomas Jefferson University to form Lambert Centre for the Research of Medicinal Cannabis and Hemp.

As for Washer, he has brought over people from Canada to help educate Australia's medical community. He says it is a work in progress.

"It's taken a number of years working, travelling around and lots of time and effort (to set up AusCann). I don't mind that. To me it's a passion."