Baron23

Well-Known Member

Gee...between the new regs, license stacking by big corps, and very high taxes...well, all I can say is "they're surprised by this????"

California's marijuana black market ramps back up

California’s move to open up its cannabis market to recreational users has had an unexpected result: A growing segment of the industry may be moving back into the shadows.

Thousands of manufacturers, growers and retailers have lost their licenses amid tighter regulations on marijuana and more oversight from local authorities, some of which aren’t too keen on the plant. The cannabis companies that still operate legally face a dizzying array of new taxes.

“Industry insiders have been referring to this as the moment of reckoning,” said Kenny Morrison, president of the California Cannabis Manufacturers Association. “Some people are going to be left flat footed, and others are going to expand their market share.”

The next hurdle is a July 1 deadline for laboratories to certify that legally sold marijuana products are free of mold and dangerous pesticides. Lab testing was delayed from the start of the year to give producers time to comply.

The new rules implement a 2016 voter-approved referendum, Proposition 64, that expanded legal cannabis sales from medical patients to all adults. Under the old rules, it had been easy for anyone seeking a prescription for marijuana products to obtain one -- and with little oversight, the market exploded.

Now, it’s shrinking again -- at least by the official count. With years of operating outside of the law, many in the industry are simply retreating away from the open market instead of dealing with the new rules.

Outnumbered

“The illicit market outnumbers us by five to one,” Morrison said. “You can go to a random city and find four legal stores and 20 illegal stores. What’s worse, those four legal stores are charging two and and three times the price of the illegal stores.”

Local authorities can now opt to ban cannabis businesses if they wish -- even those that operated legally under the old rules. Alex Traverso, spokesman for the state Bureau of Cannabis Control, said 70 percent of jurisdictions have done exactly that.

As a result, the number of licensed retailers has plunged to 410, according to the state. That’s down from about 1,100 under the old rules, according to research firm BDS Analytics. State licensed delivery services have dropped to 116, versus a BDS estimate of about 2,000 historically.

Growers face a similar shake out. About half the state’s 50,000 to 60,000 cannabis farms have been driven out of business by the new rules, and many are reverting to the black market, said Hezekiah Allen, executive director of the California Growers Association. The smallest growers are having the hardest time making the transition, he said.

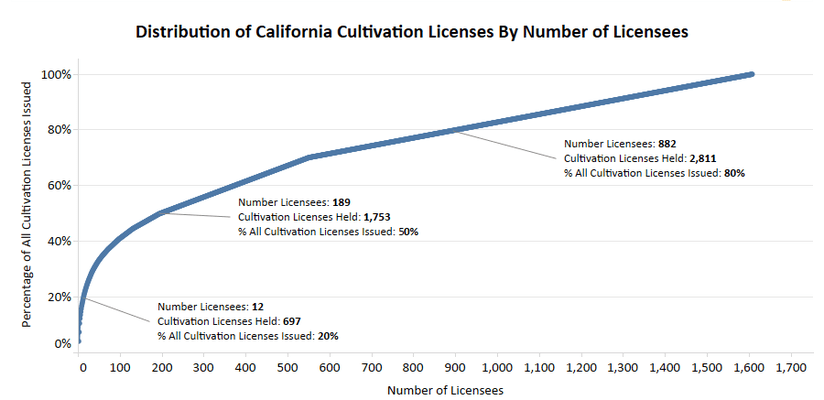

The state has issued 3,693 active grower licenses as of June 18, said Steve Lyle, a spokesman for the California Department of Food and Agriculture. The largest growers hold multiple licenses, putting the actual number of legal farms closer to 1,700, Allen said.

Story Continues Below

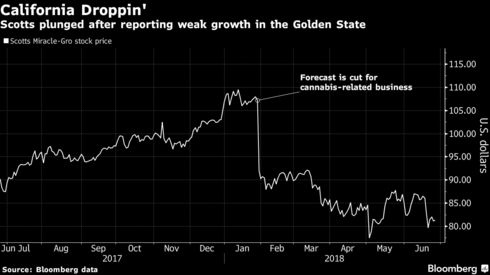

Public companies have been tripped up by the California changes as well, which were put in place largely to protect consumers. The rapid shift burned Scotts Miracle-Gro, which gets more than 20 percent of sales from the cannabis industry. Excluding acquisitions, Scotts expects sales at its Hawthorne Gardening unit, which supplies marijuana growers with products such as fertilizers and lights, to drop this year, a reversal from November when it had forecast a gain of at least 10 percent. The weaker outlook has helped send Scotts shares tumbling about 24 percent this year.

And Scotts’ woes may not be over. The July deadline for producing clean cannabis “is going to be a very disruptive event,” Allen said. Retailers are clearing out non-compliant products with fire-sale prices, and there’s no guarantee there will enough lab-cleared marijuana to replenish shelves.

‘Troubling Number’

Only about half of the marijuana products coming through Cannalysis Labs in Santa Ana pass the new pesticide standards, said Chief Scientific Officer Swetha Kaul.

“We are seeing a troubling number of failures,” Kaul said.

She’s concerned that contaminated cannabis will simply shift to the black market. Many cannabis dispensaries now operate without a license, letting them undercut legal operators that play by the rules and pay taxes.

Cannabis Control has sent more than 1,800 cease-and-desist letters to unlicensed retailers and the bureau is evaluating its next steps for those “that seem to have no intention of ever getting a license,” said Traverso, the agency’s spokesman. Governor Jerry Brown proposed a $14 million program to crack down on illicit marijuana, only to be rejected this month by the legislature in a funding dispute, according to the Los Angeles Times.

The disappearance of legal industry players is hurting business at Coastal Analytical, which has cannabis-testing labs in San Diego and Vista, said president Samuel Z. David. Licensed labs, growers, distributors and retailers can only do business with other licensed businesses.

“It’s a tough situation to muddle through,” David said. “We have bigger customers and their invoices are higher, but there are fewer of them. It kind of sucks for us.”

Oregon’s Example

David remains hopeful that California’s legal market will take off after the current rough patch. BDS Analytics says there’s reason to believe it will.

The best indicator of California’s future is Oregon, where there was similar disruption to the cannabis market during its shift to recreational, lab-tested products, said Greg Shoenfeld, BDS vice president for operations. Oregon saw shortages, spiking prices and businesses going under before the trend started to reverse after about five months, he said.

Higher prices in California would be “scary” because the heavily taxed legal market already has a hard time competing with the state’s entrenched black market, Shoenfeld said. Local taxes can be as high as 20 percent of gross receipts on top of a 15 percent state excise tax, plus sales taxes as high as 10.25 percent and a state cultivation tax of $9.25 per ounce, according to a report from Fitch Ratings.

BDS this week is cutting its 2018 forecast for California’s legal pot sales to $2.9 billion, down from as high as $3.7 billion previously, due to the slow pace of licensing and the start of lab testing, Shoenfeld said. That’s still higher than BDS estimates for the next biggest states: $1.5 billion in Colorado, $1 billion in Washington and $500 million in Oregon.

Total legal U.S. sales should rise to $11 billion this year, from $8.5 billion, according to a report by Arcview Market Research and BDS.

Product Compliance

Alex Zafrin, who manufactures marijuana-infused ice cream, has been required to overhaul his business because his products -- flavors such as Coffee Pot and Vanilla Kush -- didn’t comply with the new rules.

But he’s not abandoning California. Half a year tinkering in the kitchen has yielded a new line of dosed sweets, like Chocolate Trip cookies and Twisted and True pretzel bark, which are compliant with the new rules that regulate edibles’ potency, packaging and ingredients. And his Fully Baked Brands, which he runs with partner Rekka Nicholson, signed a licensing deal to bring their banned ice creams to Canada’s newly legal market.

“We had to start over,” Zafrin said. “Everyone in the industry is kind of scratching their heads thinking, ‘What the hell went wrong here?”’

California's marijuana black market ramps back up

California’s move to open up its cannabis market to recreational users has had an unexpected result: A growing segment of the industry may be moving back into the shadows.

Thousands of manufacturers, growers and retailers have lost their licenses amid tighter regulations on marijuana and more oversight from local authorities, some of which aren’t too keen on the plant. The cannabis companies that still operate legally face a dizzying array of new taxes.

“Industry insiders have been referring to this as the moment of reckoning,” said Kenny Morrison, president of the California Cannabis Manufacturers Association. “Some people are going to be left flat footed, and others are going to expand their market share.”

The next hurdle is a July 1 deadline for laboratories to certify that legally sold marijuana products are free of mold and dangerous pesticides. Lab testing was delayed from the start of the year to give producers time to comply.

The new rules implement a 2016 voter-approved referendum, Proposition 64, that expanded legal cannabis sales from medical patients to all adults. Under the old rules, it had been easy for anyone seeking a prescription for marijuana products to obtain one -- and with little oversight, the market exploded.

Now, it’s shrinking again -- at least by the official count. With years of operating outside of the law, many in the industry are simply retreating away from the open market instead of dealing with the new rules.

Outnumbered

“The illicit market outnumbers us by five to one,” Morrison said. “You can go to a random city and find four legal stores and 20 illegal stores. What’s worse, those four legal stores are charging two and and three times the price of the illegal stores.”

Local authorities can now opt to ban cannabis businesses if they wish -- even those that operated legally under the old rules. Alex Traverso, spokesman for the state Bureau of Cannabis Control, said 70 percent of jurisdictions have done exactly that.

As a result, the number of licensed retailers has plunged to 410, according to the state. That’s down from about 1,100 under the old rules, according to research firm BDS Analytics. State licensed delivery services have dropped to 116, versus a BDS estimate of about 2,000 historically.

Growers face a similar shake out. About half the state’s 50,000 to 60,000 cannabis farms have been driven out of business by the new rules, and many are reverting to the black market, said Hezekiah Allen, executive director of the California Growers Association. The smallest growers are having the hardest time making the transition, he said.

The state has issued 3,693 active grower licenses as of June 18, said Steve Lyle, a spokesman for the California Department of Food and Agriculture. The largest growers hold multiple licenses, putting the actual number of legal farms closer to 1,700, Allen said.

Story Continues Below

Public companies have been tripped up by the California changes as well, which were put in place largely to protect consumers. The rapid shift burned Scotts Miracle-Gro, which gets more than 20 percent of sales from the cannabis industry. Excluding acquisitions, Scotts expects sales at its Hawthorne Gardening unit, which supplies marijuana growers with products such as fertilizers and lights, to drop this year, a reversal from November when it had forecast a gain of at least 10 percent. The weaker outlook has helped send Scotts shares tumbling about 24 percent this year.

And Scotts’ woes may not be over. The July deadline for producing clean cannabis “is going to be a very disruptive event,” Allen said. Retailers are clearing out non-compliant products with fire-sale prices, and there’s no guarantee there will enough lab-cleared marijuana to replenish shelves.

‘Troubling Number’

Only about half of the marijuana products coming through Cannalysis Labs in Santa Ana pass the new pesticide standards, said Chief Scientific Officer Swetha Kaul.

“We are seeing a troubling number of failures,” Kaul said.

She’s concerned that contaminated cannabis will simply shift to the black market. Many cannabis dispensaries now operate without a license, letting them undercut legal operators that play by the rules and pay taxes.

Cannabis Control has sent more than 1,800 cease-and-desist letters to unlicensed retailers and the bureau is evaluating its next steps for those “that seem to have no intention of ever getting a license,” said Traverso, the agency’s spokesman. Governor Jerry Brown proposed a $14 million program to crack down on illicit marijuana, only to be rejected this month by the legislature in a funding dispute, according to the Los Angeles Times.

The disappearance of legal industry players is hurting business at Coastal Analytical, which has cannabis-testing labs in San Diego and Vista, said president Samuel Z. David. Licensed labs, growers, distributors and retailers can only do business with other licensed businesses.

“It’s a tough situation to muddle through,” David said. “We have bigger customers and their invoices are higher, but there are fewer of them. It kind of sucks for us.”

Oregon’s Example

David remains hopeful that California’s legal market will take off after the current rough patch. BDS Analytics says there’s reason to believe it will.

The best indicator of California’s future is Oregon, where there was similar disruption to the cannabis market during its shift to recreational, lab-tested products, said Greg Shoenfeld, BDS vice president for operations. Oregon saw shortages, spiking prices and businesses going under before the trend started to reverse after about five months, he said.

Higher prices in California would be “scary” because the heavily taxed legal market already has a hard time competing with the state’s entrenched black market, Shoenfeld said. Local taxes can be as high as 20 percent of gross receipts on top of a 15 percent state excise tax, plus sales taxes as high as 10.25 percent and a state cultivation tax of $9.25 per ounce, according to a report from Fitch Ratings.

BDS this week is cutting its 2018 forecast for California’s legal pot sales to $2.9 billion, down from as high as $3.7 billion previously, due to the slow pace of licensing and the start of lab testing, Shoenfeld said. That’s still higher than BDS estimates for the next biggest states: $1.5 billion in Colorado, $1 billion in Washington and $500 million in Oregon.

Total legal U.S. sales should rise to $11 billion this year, from $8.5 billion, according to a report by Arcview Market Research and BDS.

Product Compliance

Alex Zafrin, who manufactures marijuana-infused ice cream, has been required to overhaul his business because his products -- flavors such as Coffee Pot and Vanilla Kush -- didn’t comply with the new rules.

But he’s not abandoning California. Half a year tinkering in the kitchen has yielded a new line of dosed sweets, like Chocolate Trip cookies and Twisted and True pretzel bark, which are compliant with the new rules that regulate edibles’ potency, packaging and ingredients. And his Fully Baked Brands, which he runs with partner Rekka Nicholson, signed a licensing deal to bring their banned ice creams to Canada’s newly legal market.

“We had to start over,” Zafrin said. “Everyone in the industry is kind of scratching their heads thinking, ‘What the hell went wrong here?”’