Baron23

Well-Known Member

I wan to see the politicians who gets in the way of $40B industry......yes, money talks.....

Global cannabis market will nearly triple to US$40.6B by 2024: Study

The value of the global cannabis market is set to soar to new heights, as more countries and American states legalize the drug, according to a new industry report.

Global legal spending on cannabis is forecast to be US$40.6 billion in 2024, nearly triple the US$14.9 billion estimated to be spent this year, according to Arcview Market Research and cannabis industry analysis firm BDS Analytics, which released its annual "State of the Legal Cannabis Markets" report on Thursday.

"That's a conservative number as well if regulators wouldn't move as slowly as they are right now," said Tom Adams, managing director of industry intelligence at BDS Analytics, who co-authored the report in a phone interview with BNN Bloomberg.

While much of that growth is expected to be led by North America, which accounts for nearly 90 per cent of all spending, other markets such as Europe and Asia are expected to end cannabis prohibition with a focus on liberalizing medical markets.

"Countries are realizing that people are using cannabis anyways. They can either tax it and regulate it or they can do nothing," Adams said. "That realization is set to spread globally and won't take that long to see cannabis prohibition unravel."

Despite the U.S.'s lead in the global cannabis market, one of its biggest markets actually shrunk in 2018, the report said. Spending in California, which sparked the counterculture movement in the 1960s that boosted the popularity of cannabis, fell to US$2.5 billion in 2018 from US$3 billion due to high taxes charged by dispensaries and a well-established illicit market.

"Regulators decided to heavily tax legal cannabis in California and create very high burdens in that market," said Adams. "It's something that we see could happen in other U.S. states as well as it's starting to take place in Canada."

Spending in Canada is expected to reach US$5.2 billion by 2024, in line with an earlier forecast made by BDS Analytics. Still, the report expects the rollout of next-generation cannabis products, such as edibles and concentrates, later this year will slow the Canadian market’s growth in the near term due to the country's restrictive branding and marketing rules.

"We've been pretty cautious with Canada because of what we've seen happen in California where local regulation impacts on the downside," Adams said. "But eventually, there's the hope that regulators will notice they didn't stop cannabis consumption, but really limit legal cannabis consumption. The pendulum will eventually swing the other way."

Global cannabis market will nearly triple to US$40.6B by 2024: Study

The value of the global cannabis market is set to soar to new heights, as more countries and American states legalize the drug, according to a new industry report.

Global legal spending on cannabis is forecast to be US$40.6 billion in 2024, nearly triple the US$14.9 billion estimated to be spent this year, according to Arcview Market Research and cannabis industry analysis firm BDS Analytics, which released its annual "State of the Legal Cannabis Markets" report on Thursday.

"That's a conservative number as well if regulators wouldn't move as slowly as they are right now," said Tom Adams, managing director of industry intelligence at BDS Analytics, who co-authored the report in a phone interview with BNN Bloomberg.

While much of that growth is expected to be led by North America, which accounts for nearly 90 per cent of all spending, other markets such as Europe and Asia are expected to end cannabis prohibition with a focus on liberalizing medical markets.

"Countries are realizing that people are using cannabis anyways. They can either tax it and regulate it or they can do nothing," Adams said. "That realization is set to spread globally and won't take that long to see cannabis prohibition unravel."

Despite the U.S.'s lead in the global cannabis market, one of its biggest markets actually shrunk in 2018, the report said. Spending in California, which sparked the counterculture movement in the 1960s that boosted the popularity of cannabis, fell to US$2.5 billion in 2018 from US$3 billion due to high taxes charged by dispensaries and a well-established illicit market.

"Regulators decided to heavily tax legal cannabis in California and create very high burdens in that market," said Adams. "It's something that we see could happen in other U.S. states as well as it's starting to take place in Canada."

Spending in Canada is expected to reach US$5.2 billion by 2024, in line with an earlier forecast made by BDS Analytics. Still, the report expects the rollout of next-generation cannabis products, such as edibles and concentrates, later this year will slow the Canadian market’s growth in the near term due to the country's restrictive branding and marketing rules.

"We've been pretty cautious with Canada because of what we've seen happen in California where local regulation impacts on the downside," Adams said. "But eventually, there's the hope that regulators will notice they didn't stop cannabis consumption, but really limit legal cannabis consumption. The pendulum will eventually swing the other way."

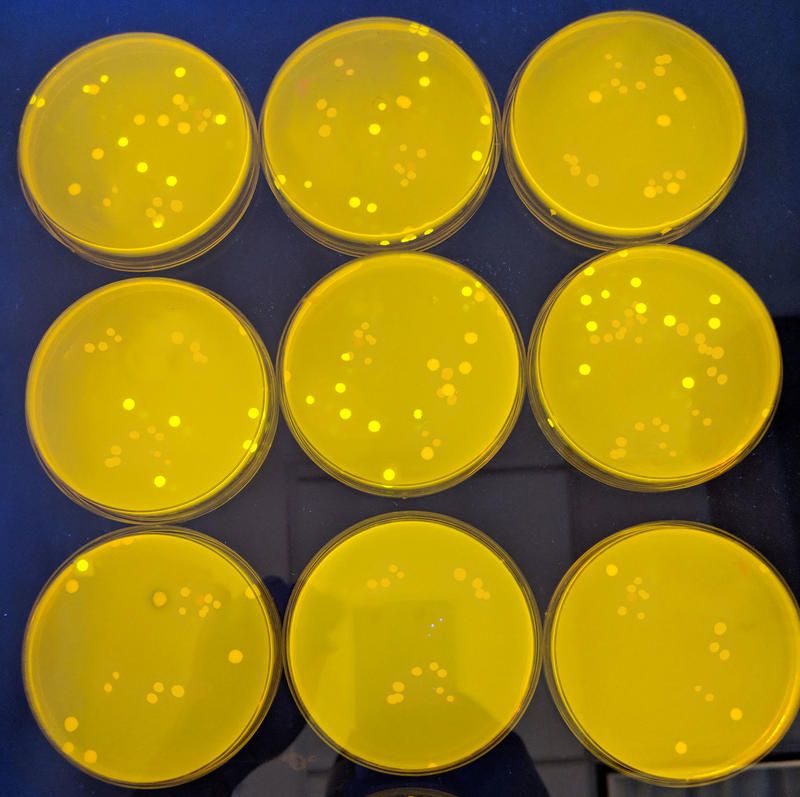

How is this safer than growing a plant? And it's for medical patients? wtf...

How is this safer than growing a plant? And it's for medical patients? wtf...